The tax reform framework released a week ago by the Trump administration and congressional Republican leaders appears a bit rickety right now. Here are four elements that are becoming sticking points:

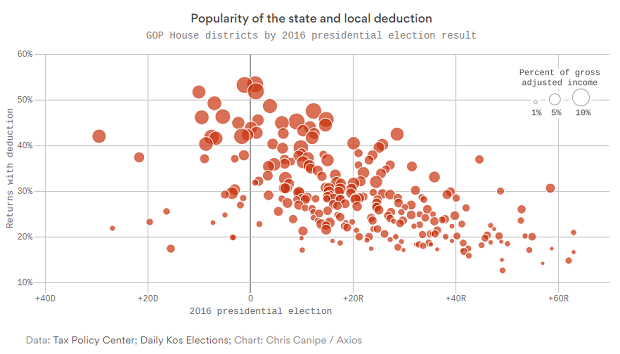

1. The state and local deduction: The Republican framework calls for eliminating this tax break, a change that would raise $1.3 trillion in revenue over 10 years. But some Republicans are backing away from a full repeal. There is a growing awareness in the GOP that eliminating the deduction wouldn’t hurt just Democratic-leaning states, which tend to have higher taxes, but also plenty of swing states that went Republican in 2016. The chart below, from Axios, shows how popular the deduction is in every GOP-held House district. Note that the biggest dots are in narrowly contested districts. No surprise then that a number of Republicans have already said that they’ll vote against tax reform unless it keeps the deduction. Looking at the potential political ramifications, Yahoo Finance’s Rick Newman concludes, “the biggest tax break Trump wants to kill — the deduction for state and local taxes, known as the SALT deduction — might just be impossible to kill.” Without it, Republicans will have to raise revenue elsewhere, or drop tax rates less than they had hoped.

2. The capital gains tax: Some Republicans want more tax cuts, not less, “including one call for reducing the capital gains rate and eliminating an Obamacare levy — measures that weren’t included in the White House and GOP framework released last week,” Bloomberg reports. These additional cuts would make the GOP tax plan more expensive, pushing the cost well past the $2 trillion mark over a decade.

3. The distributional benefits: There are plenty of questions about who would benefit from the Republican tax plan. Although Republicans have pushed back hard on the analysis, a widely-cited report from the Tax Policy Center shows that most of the benefit of the proposal would flow to the wealthiest taxpayers. “That could be a deal breaker for some members of Congress, not to mention a problem for a president who prides himself on his ability to speak to a working-class base,” Vox’s Anna North writes. One key to rebalancing the tax reform could be to increase and expand the child tax credit. The current framework calls for boosting the credit by an unspecified amount, but other changes could make it more beneficial to low-income families. “I think the child tax credit will make or break” the Republican tax plan, a sociologist who specializes in taxation told Vox.

4. The cost: Sen. Bob Corker said last week that he won’t support a tax bill that adds to the deficit, which means that lawmakers may have to modify their cuts or find trillions of dollars in new revenues. “With realistic growth projections, it cannot produce a deficit,” Corker said, raising the issue of how the tax plan will be scored. This could end up being a serious issue for any eventual tax bill. The House and the Senate must eventually agree on the size and shape of a tax reform bill, but their budget resolutions are current pretty far apart — Politico said “the two chambers' choices couldn’t look more different.” The House budget resolution says that a tax bill cannot contribute to the deficit, while the Senate version allows $1.5 trillion to be added to the deficit over 10 years. These differences need to be resolved before the more arduous process of writing a tax bill can begin. One possible result is that Republicans will embrace a more modest plan that provides smaller tax cuts, mostly to businesses. And the cuts could be temporary.