The IRS is receiving an extra $320 million to help cover the costs of implementing the Republican tax overhaul, funds that can be used over the next 18 months to assist taxpayers, revise hundreds of tax forms and update tech systems to handle the new rules.

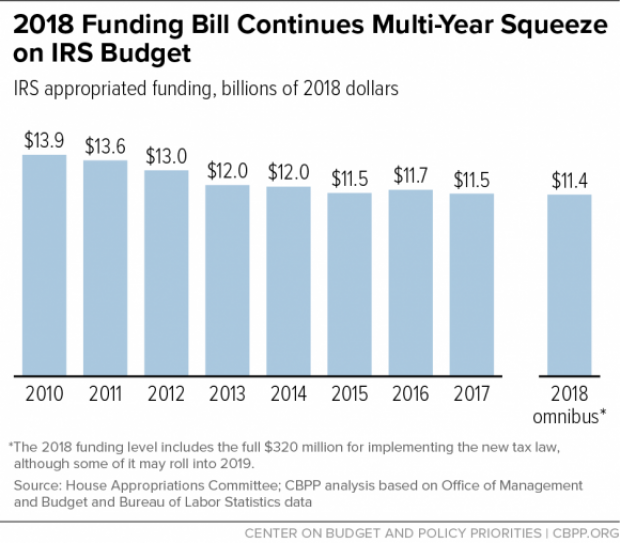

The increase represents something of a turnaround for Congress, which has been cutting funding for the agency for years. Since 2010, the IRS budget has shrunk by about $2.5 billion, or 18 percent, in inflation-adjusted dollars, and headcount has dropped by more than 13,000, according to the Center on Budget and Policy Priorities.

CBPP’s Emily Horton says that even with the $320 million boost, funding is basically flat compared to 2017, due to inflation and a $124 million cut in funding affecting other parts of the agency, leaving the IRS unprepared to deal with the challenges ahead. Enforcement has been particularly hard hit over the years, with the loss of about 25 percent of dedicated staff since 2010. This seems particularly ill-advised, Horton writes, given provisions in the new rules that “will likely fuel aggressive efforts by some businesses and wealthy individuals to push the law’s outer limits, and possibly beyond, to minimize their taxes.”