The tax overhaul that became law in December contains numerous temporary provisions that are set to expire after 2025. But Republican lawmakers, who created the expiration date in order to limit the tax package’s 10-year cost to $1.5 trillion, want to make those cuts permanent, and the House Committee on Ways and Means is working on legislation that would do just that, according to comments from Barbara Angus, the committee’s chief tax council, at a conference held by the Tax Policy Center Monday. There could be a vote in Congress as early as this spring in what President Trump has referred to as a “phase two” of the tax cuts.

Virtually all of the individual tax cuts are temporary, and making them permanent is being pitched politically as a win for middle-class taxpayers. But according to a new analysis from the Institute on Taxation and Economic Policy, the extension the temporary tax cuts after 2025 will do little to change the overall distribution of benefits provided by the tax overhaul. This is due in part to the fact that a handful of the temporary tax cuts, such as the reduction in the estate tax and the new rules for pass-through business income, benefit wealthy taxpayers most.

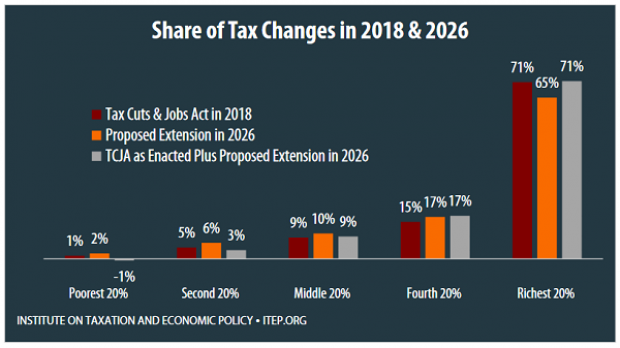

According to ITEP’s analysis, which examined tax and income changes in all 50 states, the wealthiest 20 percent of Americans receive 71 percent of the benefits of the tax legislation in 2018. The same group would receive 65 percent of the benefit of making the temporary provisions permanent. Combining the effects of the tax law and the extension of the temporary cuts, the wealthiest 20 percent still claim about 71 percent of the benefits. “This analysis,” the authors write, “finds that extending the temporary tax provisions in 2026 would not be aimed at helping the middle-class any more than TCJA as enacted helps the middle-class in 2018.”