State pension plans are facing a massive $1.4 trillion funding gap, according to a new analysis from the Pew Charitable Trust. Pension liabilities in all 50 states increased by $295 billion to roughly $4 trillion in 2016, against $2.6 trillion in assets. Although taxpayer contributions to pension funds have increased in the last decade, overall pension debt continues to climb, with 15 annual increases since 2000.

Unrealistic assumptions about investment returns on pension funds are a big part of the problem. The median assumed return on assets was 7.5 percent in 2016 – but the actual median return was a paltry 1 percent. At the same time, state contributions to their pension systems continue to fall short. Even if states had been able to earn their unrealistic assumed returns, pension obligations would have increased by $13 billion in 2016 due to funding shortfalls.

States have been slow to recognize their outsize obligations and resisted using more realistic assessments, in part because even small changes can shift the numbers dramatically. For example, reducing the assumed return on pension fund assets to 6.5 percent, down from the current median of 7.5 percent, results in an increase in overall liabilities of nearly $400 billion. And even lower but more realistic assumptions make the problem that much worse.

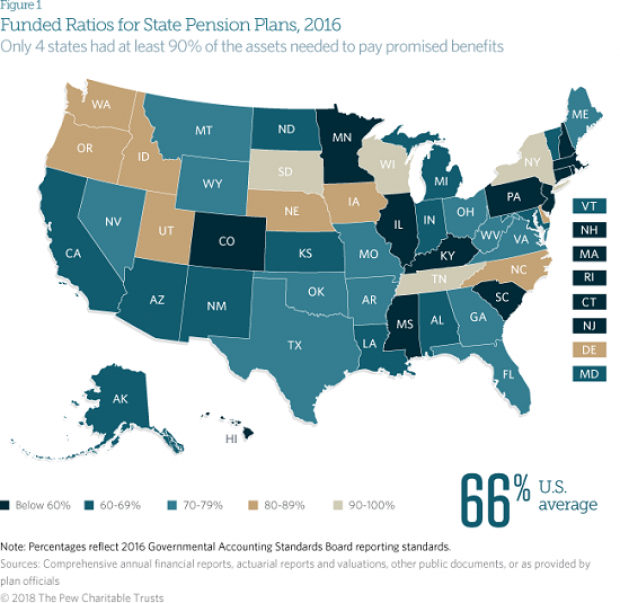

Not all states are in trouble, and the condition of pension funds varies widely. Four states – New York, South Dakota, Tennessee and Wisconsin – have funded at least 90 percent of their obligations. At the opposite end of the spectrum, five states – Colorado, Connecticut, Illinois, Kentucky and New Jersey – have funded less than half of their pension liabilities.

Pew offers a few suggestions for states to dig themselves out of their pension funding holes. First and foremost, states need to increase their contributions. Second, states can improve their fund management, with an increased emphasis on measuring risk and cash flow. And finally, states should stop making promises to pay benefits without a creating a secure funding mechanism at the same time.