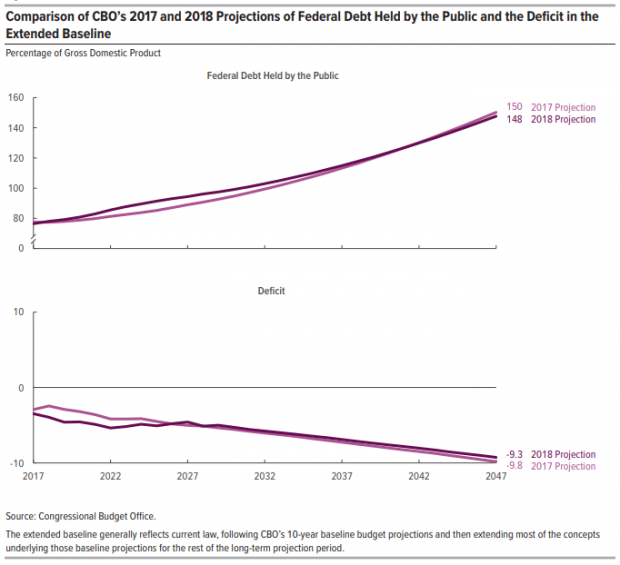

The Congressional Budget Office on Tuesday confirmed what we already knew: The U.S. faces a rising tide of red ink, with the national debt as a share of the economy projected to nearly double over the next 30 years — even without factoring in the likely extension of some tax cuts and spending increases.

In its annual report on the long-term budget outlook, the nonpartisan CBO projects that debt held by the public will rise from 78 percent of GDP now — the highest level since shortly after World War II — to 100 percent by the end of the next decade and 152 percent by 2048. “That amount would be the highest in the nation’s history by far,” the report says.

20180626_CBO.PNG

Other key details from CBO’s outlook:

- By 2034, federal debt will reach record levels, surpassing the peak of 106 percent of GDP recorded in 1946.

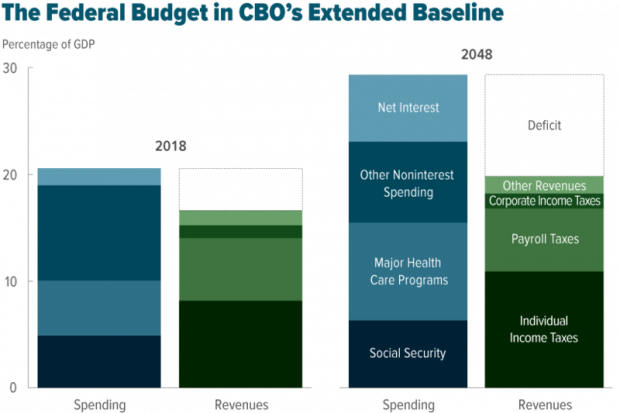

- By 2048, interest on the debt would about equal spending on Social Security, the largest federal expenditure. Interest costs will also surpass all discretionary spending by then.

- The major drivers of rising debt remain Social Security and health care, primarily Medicare — programs that will see costs rise as the population ages — as well as increasing interest costs.

- Spending as a share of GDP is projected to grow from under 21 percent this year to 29.3 percent by 2048. Revenues, meanwhile, would rise more slowly, going from 16.6 percent of GDP this year to 19.8 percent in 2048.

- Given that widening imbalance, the annual deficit is projected to climb from 3.9 percent of GDP in 2018 to an average of 8.4 percent of GDP from 2039 to 2048.

- If lawmakers wanted to keep debt stable at its current share of the economy, they would have to cut spending and/or raise revenues by a total of 1.9 percent of GDP a year, or about $400 billion for 2019. That translates to a 10 percent cut in spending or an 11 percent increase in revenue, or some combination of those changes.

The report warns: “The amount of debt that is projected under the extended baseline would reduce national saving and income in the long term; increase the government’s interest costs, putting more pressure on the rest of the budget; limit lawmakers’ ability to respond to unforeseen events; and increase the likelihood of a fiscal crisis.”

And remember – that’s all without accounting for the additional tax cuts Republicans hope to enact or higher spending levels that Congress may keep in place. “If lawmakers changed current laws to maintain certain policies now in place, preventing a significant increase in individual income taxes in 2026, for example, the result would be even larger increases in debt,” CBO says.

The Committee for a Responsible Federal Budget estimates that, if the tax cuts and spending increases are extended, the debt will reach a new record by 2029, five years earlier than in CBO’s baseline projection, and will hit 200 percent of GDP by 2048.