The U.S. economy is humming. Gross domestic product grew at an annualized 4.1 percent rate in the second quarter, the Commerce Department said Friday in its initial estimate for the period. The surge was driven by strong consumer spending, solid business investment and a jump in exports. Growth in the first quarter was revised upward, from 2 percent to 2.2 percent.

The release gave President Trump a chance to exult and claim credit for the strength of the economy, which he did both on Twitter and in remarks from the South Lawn of the White House. “We’ve accomplished an economic turnaround of historic proportions,” Trump said. But analysts warned that the healthy numbers come with several caveats.

Here’s what you need to know:

- Growth from April through June was the fastest in nearly four years, since the economy expanded at a 5.1 percent pace in the second quarter of 2014 and a 4.9 percent clip the following quarter.

- “The U.S. economy is now a $20 trillion economy, marking the first time a country has hit that level,” The Washington Post’s Heather Long tweeted.

- The growth rate over the past 12 months has been 2.8 percent — strong but not unprecedented in the current recovery. Still, the economy could reach Trump’s goal of growing at 3 percent for the calendar year. It reached 2.9 percent in calendar 2015, but hasn’t hit the 3 percent level since 2005. (Keep in mind, too, that calendar years are an arbitrary way of slicing the numbers.)

- Consumer spending rebounded after a weak first quarter to rise at a 4 percent annual rate, the highest since the end of 2014. (Revisions to the data also showed that the personal savings rate in 2017 was a surprising 6.7 percent, nearly double the 3.4 percent previously reported, although the increase was driven largely by a big boost in proprietors’ income.)

- Government consumption rose at a 2.1 percent annual rate, including 3.4 percent growth in federal spending.

- Trump’s tariffs created what may be a one-time boost. Net exports accounted for a full percentage point of the 4.1 percent growth rate, but experts said that increase likely reflects a rush by countries to buy products like soybeans before Trump’s tariffs make them more expensive. “Some giveback in this unusual spike should be expected,” J. P. Morgan economist Michael Feroli said.

The Big Questions

Was It the Trump Stimulus?

Critics across the political spectrum generally agree that the Republican tax cuts have provided a boost for the economy, and other stimulative policies such as deregulation and a big increase in federal spending are playing as important role as well. Trump’s saber rattling on trade was also a big factor in the second quarter, sparking a significant but temporary boom in agricultural exports.

Kevin Hassett, head of the president’s Council of Economic Advisers, attributed the higher growth to the full range of policies enacted by the administration, telling lawmakers ahead of the announcement that the recent increase in economic growth is “a manifestation of what we did starting last year with the regulatory work — the pullback of regulations — the energy work that we did, the tax work and the Dodd-Frank.”

House Speaker Paul Ryan was quick to claim credit, as well, tweeting, “4.1% GDP! The fastest rate of economic growth since 2014. This is exactly the type of growth we hoped for with our pro-growth economic policies.”

Researchers at Capital Economics said that the acceleration in GDP growth, especially the increase in consumer spending, “is principally due to the massive fiscal stimulus unleashed at the start of this year.” And Doug Holtz-Eakin, a Republican and former director of the Congressional Budget Office, told The Washington Post that “Trump deserves some credit. It’s unmistakable the tax bill and regulatory changes fed into this.”

Yet real data tying the economic growth specifically to the tax cuts is harder to find. James Pethokoukis of the American Enterprise Institute warned shortly before the GDP number was released that “even a very strong report won't tell us whether the Trump tax cuts, passed in December, are ‘working.’ It's just too soon.”

The new data also contained some indications that the tax cuts were not changing the economy in the way proponents of the law predicted. Ernie Tedeschi, a former Treasury economist, tweeted that nonresidential investment decelerated from the first to the second quarter. “In other words,” he wrote, “the structural story of the tax cuts -- firmer investment growth -- didn't happen this quarter.” And Paul Ashworth, chief U.S. economist at Capital Economics, told clients that “there is still little evidence that the tax cuts, or deregulation for that matter, are improving the supply side of the economy.”

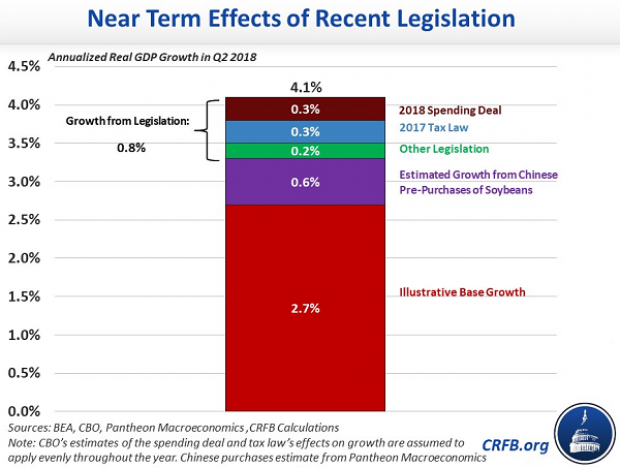

As many economists have pointed out, the tax cuts were designed to have long term effects focused on capital investment and it will take years for any such scenario to play out. Analysts at the Committee for a Responsible Federal Budget took a stab at separating out the factors contributing to the GDP growth and attributed 0.3 points of the of the total growth number to the Republican tax law and another 0.3 points to Congress’s deal this year to increase spending.

Will It Last?

This is the real key. After all, the economy has experienced several short-term growth spurts in recent years before falling back to a more tepid trendline. During President Obama’s tenure, quarterly GDP growth topped 3 percent eight times, including four quarters above 4 percent. But from the second quarter of 2009 through the end of last year, GDP has grown at averaged annualized rate of 2.2 percent.

“These numbers are very, very sustainable,” Trump said Friday. “This isn’t a one-time shot. I happen to think we’re going to do extraordinarily well in our next report, next quarter. I think it’s going to be outstanding.”

But economists are generally much less optimistic, especially about the long term. Economists surveyed by The Wall Street Journal earlier this month expected the GDP growth would slow to 3 percent in the third quarter of 2018 and 2.9 percent in the fourth quarter. “The bottom line takeaway is that this growth is not sustainable and it will slow in the second half of the year,” Lakshman Achuthan, co-founder of the Economic Cycle Research Institute, told the Post. “President Trump should celebrate this number because it is going to ease from here.”

Beyond that, while the Trump administration insists this isn’t just a short-term sugar rush, many economists still expect growth to slow significantly by 2020.