A hard-hitting report released this week from analysts at the insurance firm Willis Towers Watson claims that the health care system is responsible in large part for the lack of income growth experienced by millions of American workers.

Sylvester J. Schieber, an independent consultant retired from Willis Towers Watson, and Steven A. Nyce, director of the research and innovation center at the firm, say that their analysis “shows how since the 1980s, the cost growth of employer-provided health benefits has been shrinking workers’ wage growth, eroding their retirement benefits and becoming an increasingly important factor in growing income inequality.”

Where the pay raises went: “U.S. employers’ health care costs started small—in 1950, healthcare amounted to only 0.5 percent of total compensation,” the authors write. “But premiums rose 3.1 times faster than total compensation in the 1950s and over twice as fast in the 1960s. Over the next 40 years, health plan costs grew 3.4 times faster than compensation in the 1970s, 2.1 times faster in the 1980s and 1.2 times faster in the 1990s. By the first decade of the new millennium, health care costs were again increasing 3.4 times faster than compensation. This analysis shows that the escalation of employers’ health premiums is now consuming all compensation growth for many workers, leaving nothing to add to their paychecks ...”

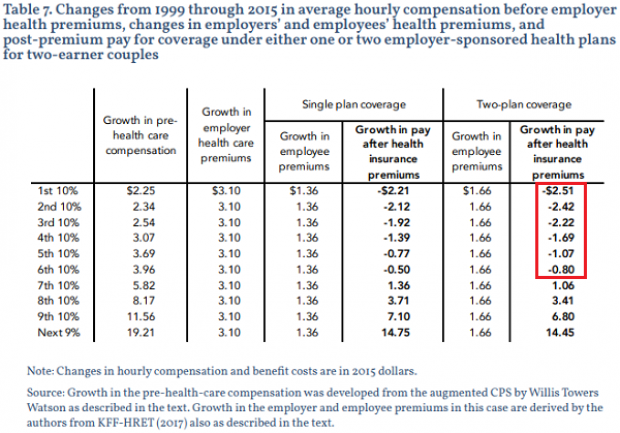

The authors found that millions of employees paying for employer-provided health insurance saw what in effect were wage losses between 1999 and 2015 due to increases in the cost of coverage. “After paying their premiums, workers in the bottom 60 percent of the earnings distribution with family coverage registered losses in earnings over the 16-year period.”

It's hurt some workers more than others: Lower-wage workers have been hit the hardest, since health care costs make up such a significant part of their total compensation. “The costs of employer-sponsored health benefits were sucking the lifeblood out of the potential economic gains for many, if not most, of these workers,” the analysts wrote.

The table below from the report shows the net loss in pay experienced by the bottom 60 percent of workers in two-earner couples with employer-sponsored health plans:

A pessimistic conclusion: Addressing the report earlier this week, Robert J. Samuelson of The Washington Post wrote, “We’d all like both cheaper health insurance and higher wages, but the way the health-care system is operating today, we might get neither. As insurance premiums get more expensive, inflation-adjusted (‘real’) wages will continue to stagnate or decline.”

The complete analysis: See the full report here.