Are you ready for some football? How about some football bets? With the opening of the NFL season, states that recently legalized sports gambling are hoping to cash in through increased tax revenue.

In the past three months, Delaware, Mississippi, New Jersey and West Virginia all began allowing sports betting parlors, mostly attached to already-operating casinos or race tracks. Those four states legalized sports gambling after the U.S. Supreme Court in May struck down a 1992 federal law barring sports betting in most states. (Nevada was granted an exemption from that law, and sports gambling has been legal there off and on since the 1930s.)

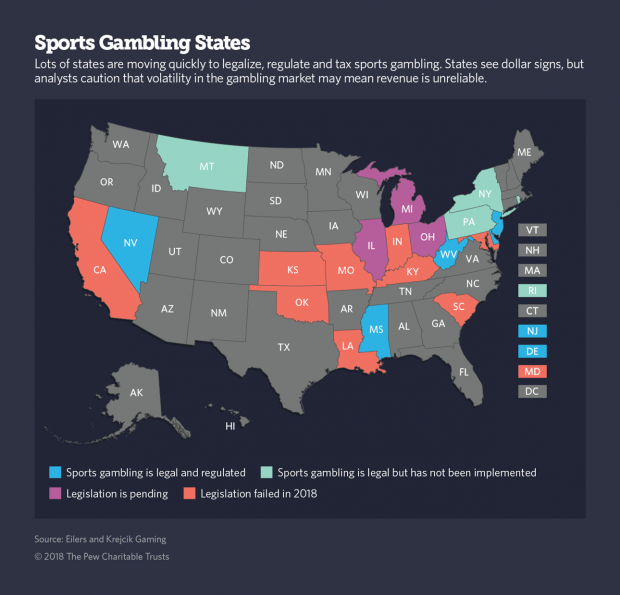

Other states want in on the action. Rhode Island and Pennsylvania, which passed laws legalizing betting on sports but have not yet opened the wagering, will be next, likely before the end of the year. A couple dozen more states have sports betting bills awaiting the 2019 legislative session. New Jersey and Nevada have online sports betting, while the other states are hoping to add online wagering in the future, some with the caveat that the bettor must be in that state.

Though some experts are skeptical, states believe the new tax revenue will make a big difference in their budgets. Much of the money is slated to go toward schools, highways and other pressing state needs.

Under-the-table NFL and college football wagers top $95 billion each year, according to the ESPN sports network. Overall, up to $150 billion is wagered illegally on sports every year in the United States, according to the American Gaming Association, a trade group.

In Nevada, tax revenue from sports gambling has grown steadily, but it still makes up a small portion of the state’s budget. Sports gambling made up 2.2 percent of total casino revenue last year, according to David G. Schwartz, director of the Center for Gaming Research at the University of Nevada, Las Vegas. Total sports gambling revenue grew 11.3 percent to $215 million last year, he said. Yet that yielded just $15 million in state taxes, about 2 percent of the state’s $725 million in sales tax revenue.

In Mississippi, lawmakers have decided that revenue from the state’s sports betting law, as well as from a new lottery approved this year, will help pay for education and road and bridge repair. Twelve percent of the state’s bridges are “structurally deficient,” according to a 2017 report from the American Society of Civil Engineers, and 28 percent of the roads are in “poor condition.”

Republican Gov. Phil Bryant has estimated that the state could take in $30 million annually from sports betting, and $80 million from the lottery. But if Mississippi’s sports betting revenue is comparable to Nevada’s, the actual number from that source is likely to be closer to $5 million, according to an analysis by the Clarion-Ledger in Jackson.

Mississippi has had casino gambling since 1990, but other forms of betting were off-limits in a state where Bible-belt anti-gambling beliefs still held sway. Nevertheless, the allure of increased revenue, along with worries about nearby states getting a jump on offering sports betting, won the day.

“There has been a desperate need for infrastructure revenue in the state for some time. That was probably a way to persuade some of the legislators over the objections of religious leaders,” said Jonathan Winburn, political science professor at the University of Mississippi.

Mississippi House Speaker Philip Gunn, a Republican, is a Baptist who opposes gambling and votes consistently against it. But Gunn did not keep the lottery or sports betting bills off the House floor. “He would rather it had not even been brought up, and then the money would not be a factor,” said Meg Annison, the speaker’s spokeswoman. But once the revenue was figured into the state’s budget, Annison said, Gunn was obligated to participate in the debate over how to spend it.

Lucy Dadayan, a senior research associate at the Urban Institute, a progressive think tank in Washington, D.C., said Mississippi and other states should be leery of counting on a huge windfall.

“Counting on revenues from lottery proceeds to fund infrastructure is immature and not a sound policy decision,” she said. “A more prudent policy option would be dedicating funding from diverse revenue streams for spending on infrastructure and other programs.”

And John Buhl, spokesman for the Tax Foundation, noted that black market sports gambling has been flourishing for years, and that if the legal market is too restrictive or too hard to access, people will continue to gamble illegally.

But the steady growth in revenue from other forms of legal gambling offers some hope to states, according to Chris Krafcik, managing director at Eilers and Krejcik Gaming, a gambling analysis firm.

“Most regulated and relatively mature U.S. gambling verticals — commercial casino gaming and tribal gaming, for example — are still growing year-over-year in revenue terms,” Krafcik said.

Whatever the total take from legal sports gambling, sports leagues want in on it.

In testimony to the New York Legislature earlier this year, the National Basketball Association argued that its costs for ensuring the fairness of its games would go up with the implementation of gambling and that the league should be compensated.

Like the other states that have legalized sports betting, West Virginia did not include a so-called integrity fee for the professional sports leagues, essentially a cut off the top for the leagues. But West Virginia Gov. Jim Justice, a Republican, has hinted that such a fee might be offered later.

Meanwhile, the money and attention have been flowing.

West Virginia’s first bettor was former Washington Redskins quarterback Joe Theismann, who placed a wager Sept. 1 on his old team at Hollywood Casino at Charles Town Races. Charles Town is easy driving distance from the greater Washington, D.C., area and its thousands of NFL team fans that the sports book hopes to attract.

Delaware Gov. John Carney, a Democrat, placed the first legal bet in his state June 5, wagering $10 on the Phillies to beat the Cubs. He doubled his money. About $23 million has been wagered in Delaware since sports betting opened, state records show.

Also in June, Democratic New Jersey Gov. Phil Murphy placed the first two bets at the Monmouth racetrack — one on Germany to win the World Cup soccer tournament (it failed to make the knockout stage) and the other on the New Jersey Devils to win next year’s Stanley Cup in hockey. And NBA legend Julius “Dr. J.” Erving, bet $5 on the Philadelphia Eagles to repeat as Super Bowl champions. Those odds are currently 10 to 1.