The $1.5 trillion Republican tax overhaul came with some big promises, including faster economic growth, increased business investment and significantly higher wages for American workers. Ten months after the tax cuts took effect, Jim Tankersley and Matt Phillips of The New York Times took a fresh look at how the economy is performing and found decidedly mixed results.

On the positive side of the ledger, Tankersley and Phillips cite these factors:

- economic growth picked up in the second and third quarters

- corporate profits have risen

- share buybacks are surging

- capital investment rose early in the year

- most workers are earning more.

But there’s more to the story, and the authors say that the tax cuts appear to be falling short in several key areas:

- the bump in economic growth is looking like a short-term sugar high

- capital investment has fizzled

- wage growth has not accelerated

- corporate tax receipts have fallen by a third

- the deficit is rising sharply, despite the economic boom.

The authors acknowledge that the real test for the tax overhaul is over the long haul, as companies begin to reap the rewards from new investments, so a snapshot at 10-months is inevitably incomplete. Nevertheless, their analysis supports what many critics of the tax cuts have claimed – that the GOP tax legislation was overwhelmingly tilted toward the wealthy, with few benefits for most Americans and significant long-term costs. Two data points discussed by Tankersley and Phillips highlight that perspective.

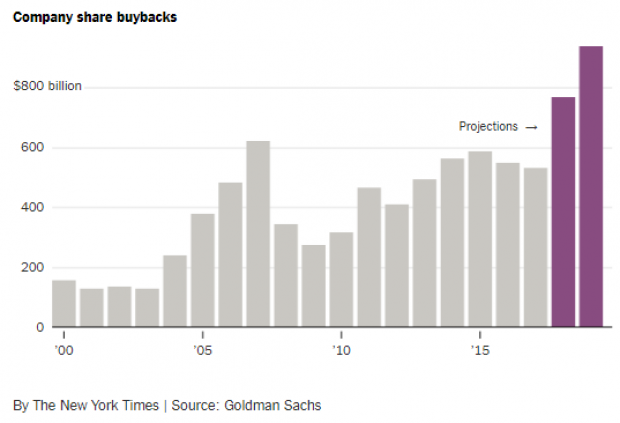

On the one hand, share buybacks are headed for record levels in 2018, driven in large part by the corporate tax cuts (see the chart below for Goldman Sach’s projections).

More broadly, the owners of corporate stock are looking at an enormous payout in the wake of the tax cuts: “The flow of repatriated corporate cash is just one tributary in what has become a flood of payouts to shareholders, both as buybacks and dividends. Such payouts are expected to hit almost $1.3 trillion this year, up 28 percent from 2017, according to estimates from Goldman Sachs analysts,” Tankersley and Phillips write.

On the other hand, while most workers are earning more this year than last year, the gains are relatively modest. Citing a report from the nonprofit research group Just Capital, which reviewed pay raises at 1,000 large companies, the authors say that “the typical worker at one of those large companies has received about $225 this year in increased salary, a one-time bonus, or both, attributable to the new law.” Even worse, some large companies are actually cutting jobs. Again citing Just Capital, the authors say that “since the tax cuts were passed, the 1,000 largest public companies have actually reduced employment, on balance. They have announced the elimination of nearly 140,000 jobs — which is almost double the 73,000 jobs they say they have created in that time.”