Weighed down by budget cuts and staff reductions, the number of audits performed by the Internal Revenue Service has been dropping for years. A new report from ProPublica and The Atlantic takes a look at the long, slow decline of the tax agency, which authors Paul Kiel and Jesse Eisinger say is now “a bureaucracy on life support.”

The agency is failing to collect at least $18 billion a year due to its organizational woes, they say – and the total annual loss could be considerably higher.

The decline of the IRS has been a long time coming, Kiel and Eisinger say, dating back to the Gingrich Revolution in 1994. Since that time, many Republicans have vilified the IRS, with some calling for its wholesale elimination. Budget cuts became the norm starting in 2010, when the GOP regained control of the House as part of a backlash against the Affordable Care Act, which required the IRS to administer some of its provisions. Today, the agency is “understaffed, hamstrung and operating with archaic equipment,” the authors write, with little hope for a turnaround on the horizon.

The piece is well worth a closer look. Some key details and shocking numbers:

* The IRS budget was $12 billion in 2017, $2 billion less than in 2010.

* The number of auditors at the IRS fell to 9,510 last year. The last time the agency had fewer than 10,000 auditors was 1953.

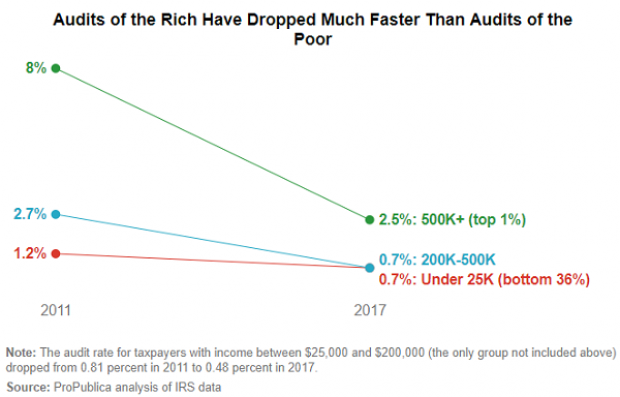

* The audit rate has fallen by 42 percent, with the IRS conducting 675,000 fewer audits in 2017 than it did in 2010.

* Investigations of non-filers – people who don’t file any kind of tax return – have fallen from 2.4 million in 2011 to 362,000 in 2017.

* Uncollected debt is “expiring” – passing the 10-year mark, at which point the IRS gives up on collecting it – at record levels. In 2010, about $540 million in uncollected tax debt expired; in 2017, that figure was $8.3 billion.

* Corporations and wealthy taxpayers are the biggest winners from the decline in audits and the loss of seasoned analysts and general expertise. The chart below shows the reduction in the audit rate since 2011 for taxpayers earning $500,000 or more.