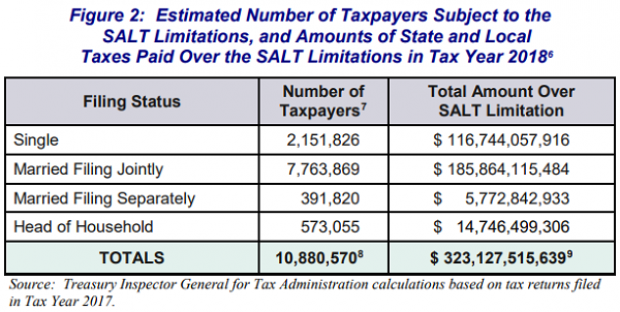

Nearly 11 million tax filers will run into the $10,000 limit on state and local tax deductions that went into effect last year as part of the Republican tax overhaul, according to an audit released this week by the Treasury Inspector General for Tax Administration.

The cap on the deduction, which hits residents of high-tax states such as New York and California particularly hard, will mean that taxpayers cannot deduct about $323 billion in state and local tax payments on their 2018 federal returns. That doesn’t necessarily mean they’ll pay higher taxes, though, since other provisions of the law may make up for the lost deductions.

The SALT deduction cap remains controversial, and some blue state lawmakers continue to explore ways to limit or even eliminate it. President Trump said he was open to changing the limit in a meeting with New York Governor Andrew Cuomo earlier this month, but Congress is not expected to revisit the provision any time soon.