A handful of supply-side enthusiasts are sticking to their claim that the Republican tax cuts are paying for themselves, with Art Laffer making that argument on CNBC just last week, but the overwhelming consensus is that the tax overhaul has pushed the federal government deeper into the red. William Gale and Aaron Krupkin of the Tax Policy Center revisited the topic Wednesday, and concluded once again that the tax cuts are neither increasing revenues nor paying for themselves:

“While some [Tax Cuts and Jobs Act] supporters are touting that nominal revenues were higher in fiscal year (FY) 2018 than in FY2017, that comparison does not address the question of TCJA’s effects. Nominal revenues rise because of inflation and economic growth. Adjusted for inflation, total revenues fell from FY2017 to FY2018. Adjusted for the size of the economy, they fell even more.”

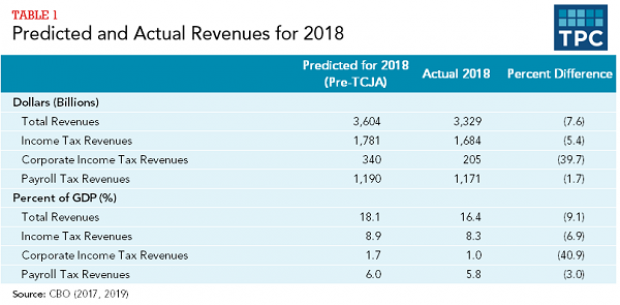

As the table below indicates, federal revenues were lower in every category in fiscal year 2018 compared to the projected revenues without the tax cuts. And the revenue declines for the calendar year are even greater, since the fiscal year includes three months (October to December 2017) before the tax cuts took place.

“None of these findings should be surprising,” Gale and Krupkin write, since just about every major analysis – including those by the Congressional Budget Office, the Joint Committee on Taxation, the Tax Policy Center, the Penn-Wharton Budget Model and academic researchers Robert Barro and Jason Furman – concluded that the tax cuts would significantly reduce revenues. And there’s no reason to believe that economic growth will make up the loss, the authors say, since those same analyses concluded that higher economic growth sparked by the tax cuts would cover an average of just 20 percent of the overall cost.