The U.S. economy is chugging along. A new CNN poll found that 71 percent of Americans say that economic conditions are good, the highest percentage to say that since 2001. And the White House is happy to take credit for it. The 2019 Economic Report of the President, released Tuesday, says that the economy is strong thanks to the Trump administration’s economic program of tax cuts and deregulation.

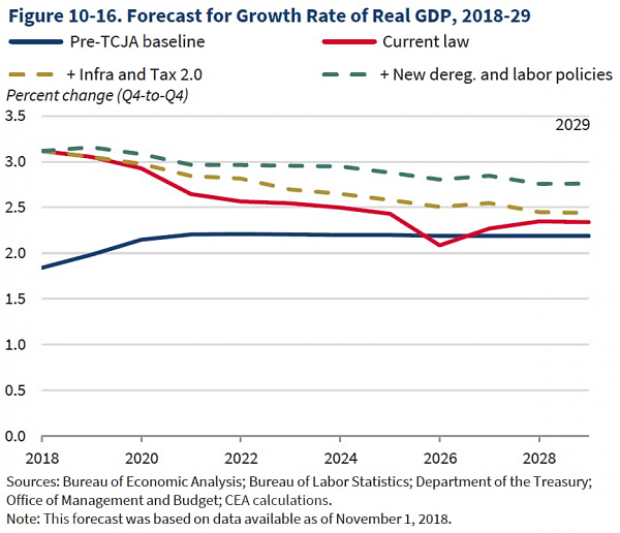

Coming in at more than 700 pages, the report sings the praises of Trump’s economic policy and attempts to make the case that the last two years mark a new era of growth. Looking ahead, the report projects higher levels of growth well into the future, with output rising “at an average annual rate of 3.0 percent between 2018 and 2029.”

This estimate, however, comes with a huge footnote: It assumes the “full implementation of the Trump Administration’s economic policy agenda.”

What’s on that agenda? A host of proposals that are unlikely to become law anytime soon, given Democratic control of the House: more tax cuts, a major infrastructure bill, more deregulation and new policies for moving people from government aid programs to full-time, private-sector employment.

If the Trump administration is unable to enact its agenda, economic growth will fall below 3 percent next year and drop to 2.5 percent by 2022 and about 2 percent by 2026, the report said.

Here’s the chart from the report showing the different trajectories, with the top line representing GDP growth assuming Trump’s economic policies become law and the lower red line showing growth if they don’t:

In comments Tuesday, White House officials appeared to ignore the clear implications of the report for lower growth. Kevin Hassett, the chair the Council of Economic Advisers and lead author of the report (pictured above), again stated his argument that the 3 percent growth rate is sustainable due to investments sparked by the tax cuts. And he rejected the idea that the higher growth seen in 2018 was just a short-term boost.

“Some folks have said, ‘Oh, sure, we did have 3 percent growth [in 2018], but that was a sugar high,’” Hassett told reporters. “Our view is that’s really not a sugar high at all. A sugar high would be, ‘We spent a lot of money on Twinkies, and now we’re sorry we ate all those Twinkies, and we don’t have any money left.’”

Hassett continued, “But this is — we actually cut taxes to encourage people to build new factories, and we got the new factories last year. We’re going to get more new factories this year, but we’re also going to get the output from the factories we built last year as they turn them on.”

However, the president’s economic report undermines these claims, and just about every other expert agrees that last year’s growth was closer to a sugar high than a fundamental rewiring of the economy.

The CNBC Fed Survey for March, also released Tuesday, showed that analysts expect GDP growth to fall to 2.3 percent this year and 2.0 percent in 2020. Slowing global growth and Trump’s protectionist trade policies were cited as the top two problems weighing on the economy.