Markets reeled Tuesday as investors contemplated President Trump’s latest threats in his burgeoning trade war with China. Amid news that trade talks weren’t going well, the president threatened on Sunday to raise tariffs to 25 percent from the current 10 percent on $200 billion of Chinese goods. He also said he might impose an extra 25% tariff on another $325 billion of Chinese goods “shortly.”

Trump has repeatedly cited the tariffs as a contributing factor to the relatively strong economic growth seen in recent months, but most economists agree that tariffs function as taxes on American consumers and manufacturers. An importer pays a tariff on goods coming from overseas and has several options for what to do about that increased cost. According to a Reuters analysis Monday, a U.S. importer can:

1. Pay the full cost of the tariff, with a loss of profit.

2. Reduce other costs (potentially including layoffs) to make up for the higher import cost.

3. Seek a discount from the supplier.

4. Find a new supplier in a no- or low-tariff country.

5. Raise prices to make up for the higher cost.

While importers may use some combination of those options, much of the cost ends up being passed on onto companies and consumers. A recent study by the Peterson Institute for International Economics found that Trump’s steel and aluminum tariffs added 9 percent to the price of steel products sold in the U.S. last year, for a total of $5.6 billion in extra costs. Overall, the tariffs have added about $11.5 billion in costs to the U.S. economy on an annual basis – and Trump is threatening to raise that number.

“[Trump’s] assertion generally that the Chinese are paying these tariffs is just simply nonsense. It’s a complete misunderstanding of how tariffs work, because tariffs are paid by the importing company and those companies are overwhelmingly American,” said Jacob Kirkegaard of the Peterson Institute. “Ultimately, that means this is a tax paid by the American consumers. The idea that it’s somehow something the Chinese pay is wrong.”

As far as government revenues are concerned, Trump’s tariffs aren’t moving the needle. “In theory, the government should be earning $32.5 billion a year on top of what they were already earning. That hasn’t happened,” Kirkegaard said. “If you look at tariff revenue in 2018, it was only about $50 billion, whereas in 2017, it was about $35 billion. It hasn’t gone up by as much as you’d think.” And even if tariff revenues were to increase further, they would be a drop in the bucket relative to the more than $3 trillion the Treasury takes in annually.

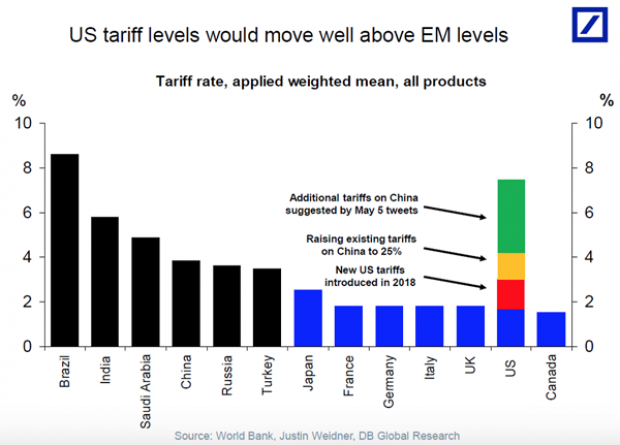

Although the tariffs aren’t doing what Trump claims they are, they nevertheless are having a real effect, as Tuesday’s market performance indicates. In a note to clients, Deutsche Bank's Torsten Slok pointed out just how unusual President Trump’s approach to tariffs is: "If the US follows through on the latest trade war threats it will raise the overall US tariff level to 7.5%, which is higher than in many emerging markets" and well above the levels seen in other industrialized nations, the economist said.