The national debt will reach “unprecedented levels” over the next 30 years, according to the new long-term budget outlook released Tuesday by the Congressional Budget Office. Federal outlays will exceed revenues during the entire period, as increased spending on Social Security, Medicare and interest on the debt outpaces more modest increases in tax revenues.

Debt held by the public is projected to rise from the current level of 78% of GDP to 144% of GDP by 2049 – far higher than the 106% of GDP recorded in 1946, on the heels of the historic military buildup during World War II.

The CBO said the rate of increase in debt expenses has slowed slightly compared to last year’s estimate, largely due to lower interest rate projections, and future debt levels could be larger or smaller than current estimates depending on productivity growth and interest rates between now and 2049. Still, virtually all projections show a substantial increase in debt over the 30-year window.

Some additional key details from the report:

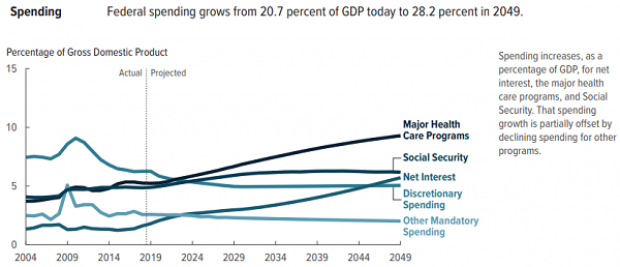

* Interest costs are projected to rise significantly. “In CBO’s extended baseline projections, net outlays for interest more than triple in relation to the size of the economy over the next three decades, exceeding all discretionary spending by 2046.”

* Demographics play an important role. As analysts have long understood, the ongoing retirement of the Baby Boomers will drive Medicare and Social Security spending higher in the coming years. Rising health care costs per person are particularly important, since they amplify the effects of an aging population.

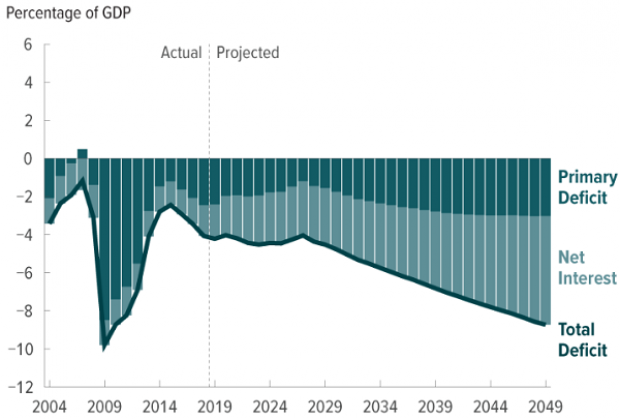

* Annual deficits are expected to grow. The Republican tax cuts reduced federal revenues as a percentage of GDP and the most recent spending deal raised spending well above the caps imposed by the Budget Control Act, producing a deficit equal to 4.2% of GDP in 2019. The CBO expects the deficit to rise to 4.5% of GDP by 2029 and 8.7% of GDP in 2049 – far above the 2.7% average recorded over the past 50 years.

* Stabilizing the debt could be painful. In order to hold the debt at its current level of 78% of GDP, the federal government would need to do some combination of tax increases and spending cuts totaling 1.8% of GDP every year beginning in 2020.

* Political decisions could make things worse. The CBO analysis assumes that current policies governing government spending and tax levels will remain in effect. But if lawmakers decide to change those policies – especially raising spending above the budget caps in 2020 and overriding the expiration of the individual tax cuts in 2026 – then the debt could be substantially larger, rising to 219% of GDP by 2049.

* Rising debt levels come with increased risks. “The prospect of such large deficits over many years, and the high and rising debt that would result, poses substantial risks for the nation and presents policymakers with significant challenges,” CBO Director Phillip Swagel said. Those risks include a possible dampening effect on economic growth and a greater likelihood of experiencing a fiscal crisis.

Read “The 2019 Long-Term Budget Outlook” from the CBO.