President Trump is apparently still considering a plan to cut taxes by indexing capital gains to inflation — even after Trump had appeared to publicly reject such a move last month for fear that it would be perceived as “somewhat elitist.”

Trump on Friday retweeted a link to a piece by GOP Senator Ted Cruz of Texas and anti-tax activist Grover Norquist advocating for the change. “An idea liked by many?” Trump said in his tweet. The White House later confirmed to The Washington Post that it is still considering the idea of bypassing Congress and enacting a capital gains tax cut via its regulatory power. The Treasury Department, the White House Office of Management and Budget and the Council of Economic Advisers continue to study the possibility of indexing capital gains, The Washington Examiner reported Tuesday, citing a senior administration official.

How it would work: Indexing would reduce tax bills for investors who sell assets such as stocks or real estate by adjusting their initial purchase price to reflect the effects of inflation. For example, if someone bought a share of stock for $100 in January 2000 and sold it for $200 in July 2018, their nominal capital gain would be $100, but their gain after adjusting for inflation would be only $51, according to the Tax Foundation.

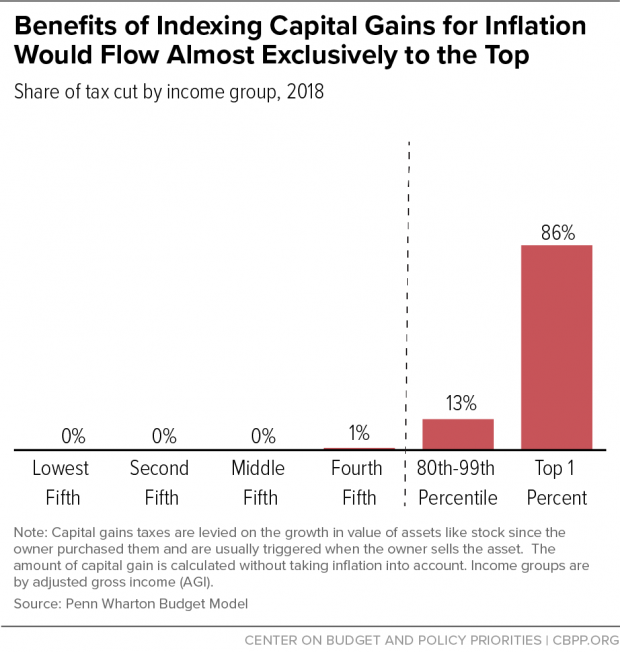

An estimated 86% of the benefit of indexing capital gains would go to the top 1% of income-earners, according to a 2018 analysis by the Penn Wharton Budget Model. And the tax cut would reduce federal revenue by an estimated $102 billion over a decade, the model found. The Tax Foundation puts the cost even higher: $178 billion over 10 years, or $148 billion after accounting for the additional economic growth the cut might generate.

Why it makes sense:

1. It’s a matter of fairness. Taxing inflation is unfair and discourages investment, proponents of the tax cut argue. In their op-ed, Cruz and Norquist give the example of a taxpayer who bought one share of Coca-Cola stock in 1998 for $32.38. If they sold the stock earlier this year at $48.13, they’d owe $3.75 in taxes on their nominal gain of $15.76. But the inflation-adjusted cost of the stock in today’s dollars would be $50.50, they wrote. “That means the taxpayer would have to pay $3.75 in taxes on a $2.38 loss. Even when a taxpayer experiences a real gain, the effective capital gains rate can easily double the statutory rate passed by Congress.”

Why it doesn’t make sense: The list of reasons is long.

1. It won’t do much for the economy. The Penn-Wharton Budget Model projects that indexing would produce “roughly zero net additional economic growth during the 10-year budget window. And an analysis by The Tax Foundation’s Kyle Pomerleau found that the change “would increase the long-run size of the economy by 0.11 percent.” That’s not much. A number of economists argue that a tax cut that overwhelmingly benefits the rich like this one does would provide less stimulus that one that targets the poor or middle class, who would be more likely to spend the money and thus boost the economy.

2. It would be “a terrible political move.” If indexing capital gains is intended to stimulate the economy, it’s far from the best option. “From a political perspective, any economic stimulus should be provided to the maximum number of people. That’s even more true in this instance, since much of the current drag on the economy could be ascribed to the president’s tariffs against imported Chinese goods,” The Washington Post’s Henry Olsen writes. “Indexing the capital gains tax would accomplish the opposite goal.”

Just a couple of weeks ago, Trump himself acknowledged the political risks of enacting another tax cut that would disproportionately benefit the rich. “I’ve studied indexing for a long time,” he told reporters. “I think it will be perceived if I do it as somewhat elitist. I don’t want to do that.” And, as Olsen notes, Trump would likely benefit directly from such a tax break if he sold long-held assets, opening him up to additional criticism that he’s using his office for financial gain.

3. It would be legally questionable: The Justice Department’s Office of Legal Counsel under President George H.W. Bush concluded in 1992 that the Treasury Department does not have authority to make the change via regulation. Trump told reporters last month that he believes he could bypass Congress but would “need a letter from the attorney general."

4. The inflation indexing would be complicated, and could create new loopholes. “It’s very difficult technically to pull off without creating a whole bunch of tax shelters and inefficiencies,” Steve Rosenthal, a tax expert at the Tax Policy Center told The Washington Post. For more on how complicated indexing could be, see this post by the Tax Policy Center’s Leonard E. Burman.

5. The capital gains tax rate is already lower than that on income. Vox points to a recent paper on indexing by a pair of tax experts, the University of Chicago’s Daniel Hemel and NYU’s David Kamin. The two write that our current tax system “affords a lower statutory rate for capital gains as a sort of ‘rough justice’ that partially accounts for inflation.” And Vox’s Dylan Matthews adds that this arrangement “makes particular sense now, as inflation has been low (around or below 2 percent) and stable for decades. It’s a normal cost that businesses can plan around, and that the tax code can offset, rather than an unpredictable danger.”

6. The fairness argument isn’t being applied fairly. “There are lots of other parts of the tax code that it might make sense to index for inflation, some of which could raise taxes on investors,” Slate’s Jordan Weissmann writes, based on an interview with Pomerleau. “But the White House isn’t trying to address those—it’s just trying to enact a tax cut by fiat.” Pomerleau told Weissman that the White House push “would easier to defend if they said ‘we want to index everything because we think inflation interacts with the tax code and that’s unfair.’ But that’s simply not what they’re doing.”