Elizabeth Warren released a proposal to tax companies that spend more than $500,000 a year on lobbying the federal government. The goal of the plan is to “end lobbying as we know it,” Warren said in statement, by increasing the cost of “excess lobbying.”

The proposal is part of Warren’s broader effort to combat what she sees as corruption in the U.S. political system. “[C]orporate interests spend more on lobbying than we spend to fund both houses of Congress - spending more than $2.8 billion on lobbying last year alone,” Warren said. “That’s why I have a plan to strengthen congressional independence from lobbyists and give Congress the resources it needs to defend against these influence campaigns.”

How it would work: Warren’s plan, which exempts charitable and social welfare organizations, would impose a new tax on lobbying expenditures, with the tax rate growing progressively higher along with spending:

- 35% tax on lobbying expenditures between $500,000 and $1 million

- 60% tax on lobbying expenditures between $1 million and $5 million

- 75% tax on lobbying expenditures above $5 million.

How much money it would raise: While Warren’s objective is to reduce the influence of lobbyists and the billion-dollar firms they represent, the tax would produce significant revenues if companies continued to lobby as they do today. Warren said that if the tax had been in effect over the last 10 years, more than 1,600 companies would have paid about $10 billion, based on their history of lobbying expenditures. The maximum rate of 75% would have been applied to 51 companies, including Pfizer, Boeing, Microsoft, Walmart, Exxon and Koch Industries, Warren said.

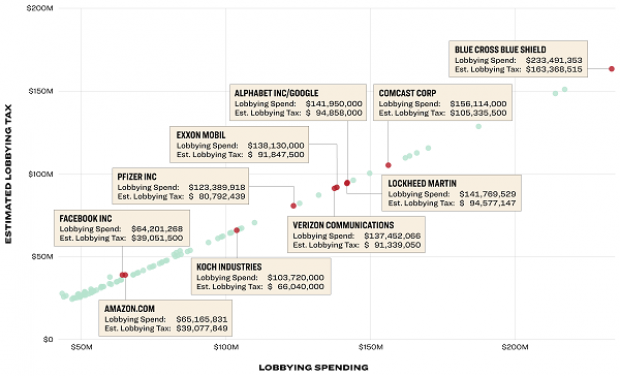

Warren’s campaign released a chart (see below) that shows how some of the biggest spenders on lobbying would have fared with the tax over the last decade. Alphabet/Google, for example, would have faced a $94 million tax bill in its $141 million in spending on lobbying during that time. The biggest spender, the U.S. Chamber of Commerce, would have paid about $770 million on its roughly $1 billion in lobbying spending.

Would it work? The proposed tax would likely be challenged on legal grounds. “I think any plan to tax lobbying is almost certainly unconstitutional,” Robert Kelner of the law firm Covington & Burling told Time. “It’s extraordinarily likely to be struck down by the Supreme Court if not by lower courts, because it would directly undermines the First Amendment right to petition our government,” he added.

Other experts disagree, however, arguing that the current, big bucks lobbying system is far from anything the Constitution’s framers could imagine. “There is no constitutional right to an unregulated, opaque and informal access to the Congress or to any legislature,” University of Pennsylvania law professor Maggie Blackhawk said. “That’s not what the petition clause was drafted to protect.”

Other objections to Warren’s proposal are more practical. Scott Greenberg, formerly with the Tax Foundation, said that companies would likely find ways around the regulations. “One avoidance technique would be to split your lobbying among lots of small groups, to avoid the $500k threshold,” Greenberg said. “Instead of one pharma trade group, create fifty separate ones.”