The highest-income households in the U.S. have seen an enormous reduction in their overall tax burdens since 1950, a development highlighted Sunday by The New York Times’ columnist David Leonhardt, using data from a forthcoming book by economists Emmanuel Saez and Gabriel Zucman.

“Every tax that falls substantially on the wealthy has plummeted over the past 70 years,” Leonhardt said, citing taxes on personal and corporate income, investments and estates.

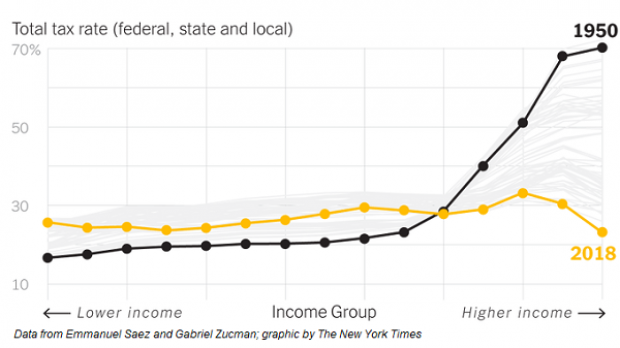

The drop has been particularly noticeable at the very top of the income spectrum. “The overall tax rate on the richest 400 households last year was only 23 percent, meaning that their combined tax payments equaled less than one quarter of their total income,” Leonhardt wrote. “This overall rate was 70 percent in 1950 and 47 percent in 1980.”

Leonhardt ‘s piece includes a dynamic chart showing the change in the overall tax rate across the income spectrum from 1950 and 2018. The chart below fills in the first and last years in the analysis — clearly displaying the dramatic reduction in the total tax rate for households in the upper part of the income distribution over a nearly 70-year period.

Leonhardt said the data also show that the superrich now pay a lower tax rate than even the poor: “For the first time on record, the 400 wealthiest Americans last year paid a lower total tax rate — spanning federal, state and local taxes — than any other income group, according to newly released data.”

Middle class households, by comparison, have seen little change in their overall tax rates, with higher payroll taxes largely offsetting lower federal income taxes.

Other analysts pointed out a possible flaw in the numbers: They doesn’t appear to include refundable tax credits such as the Earned Income Tax Credit and the Child and Dependent Care Credit, which the Congressional Budget Office and others count as tax cuts. Doing so would presumably reduce the total tax rate for lower-income households (the left side of the chart) and possibly undercut the claim that the highest-income households now pay the lowest tax rate. There’s a vigorous debate going on about this on tax Twitter, some of which you can see in this thread.

Why it matters: Leonhardt’s piece, and the analysis by Saez and Zucman, is just the latest element in an ongoing push from the left against the prevailing tax orthodoxy that has existed over the last few decades — namely, that lower taxes are always better for both individuals and the economy. Economists Saez and Zucman want to reinstate dramatically higher taxes on upper-income households, which they say will foster a more dynamic economy, pointing to the historical record for evidence to back up their claim. “The American economy just doesn’t function very well when tax rates on the rich are low and inequality is sky high,” Leonhardt wrote. “It was true in the lead-up to the Great Depression, and it’s been true recently. Which means that raising high-end taxes isn’t about punishing the rich (who, by the way, will still be rich). It’s about creating an economy that works better for the vast majority of Americans.”