There’s a $30 trillion question looming over Elizabeth Warren’s presidential campaign: How would she fund the cost of the Medicare-for-All plan she proposes?

The issue was the subject of repeated attacks on Warren at Tuesday night’s Democratic debate, with the Massachusetts senator again refusing to directly address whether she would raise middle-class taxes. Instead, as she has done throughout her campaign, Warren emphasized that, while costs will go up for the wealthy and corporations, she would not sign a bill that raises total costs on middle-class households.

There’s a reason Warren has been cagy on the question — a stark contrast to her approach on most other issues: She is still formulating her funding plan and considering the tax increases proposed by Bernie Sanders along with other revenue-raising options.

"She's reviewing the revenue options suggested by the 2016 Bernie campaign along with other revenue options,” a Warren campaign aide said in a statement to CNN. “But she will only support pay-fors that meet the principles she has laid out in multiple debates."

Coming up with an answer — especially a politically palatable one — isn’t easy. And a new analysis released this week by the Urban Institute highlights the size of the challenge. The study looked at eight versions of health-care reform, including a comprehensive single-payer plan along the lines proposed by Warren and Sen. Bernie Sanders. It found that a government-run system similar to Medicare for All would raise national health care spending by $720 billion in its first year, and federal health-care spending would rise by $34 trillion over 10 years. Factoring in some tax offsets, the government would still be short some $32 trillion in revenue.

“How big a lift is it to raise $32 trillion?” Ronald Brownstein writes at The Atlantic. “It’s almost 50 percent more than the total revenue the CBO projects Washington will collect from the personal income tax over the next decade (about $23.3 trillion). It’s more than double the amount the CBO projects Washington will collect over the next decade from the payroll tax that funds Social Security and part of Medicare (about $15.4 trillion). A $32 trillion tax increase would represent just over two-thirds of the revenue the CBO projects the federal government will collect from all sources over the next decade (just over $46 trillion.)”

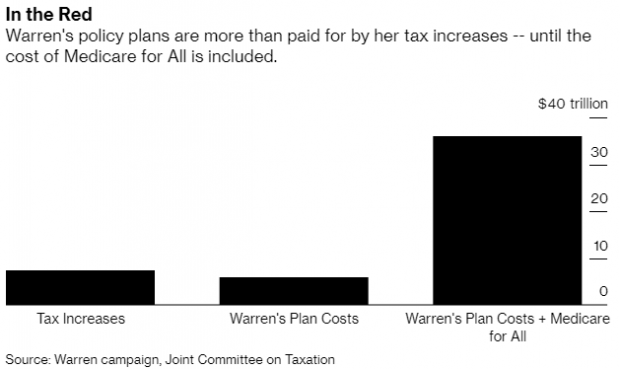

The tax increases Warren has proposed thus far — including a wealth tax, a corporate surtax, a higher estate tax and the repeal of the 2017 GOP tax cuts — would cover the cost of other programs she has proposed, but not Medicare for All. Warren’s proposals aside from Medicare for All would cost nearly $6 trillion, according to Bloomberg News, while her tax proposals would raise more than $7.3 trillion. “Her taxes as they currently exist are not enough yet to cover fully replacing health insurance,” University of California, Berkeley economics professor Emmanuel Saez, who has advised the Warren campaign, told Bloomberg News.

Raising middle-class taxes would have to be part of any plan to close that gap, experts say, though Saez told Bloomberg that those higher taxes would be more than covered by the wages gains resulting from a transition to a new health-care system that eliminates premiums for individuals covered by their employers. “It’s true that we might have to pay an extra tax but it can be structured in a way that we gain in extra wages, bigger than whatever extra tax will be there,” he said.

Read more at The Atlantic, Bloomberg News and CNN.