House Democrats on the Ways and Means Committee voted Wednesday to advance a temporary repeal of the $10,000 cap on the state and local tax deduction.

The bill, which advanced largely along party lines, lifts the 2019 cap for married couples filing jointly to $20,000 and repeal the cap entirely for 2020 and 2021. An amendment would double the maximum amount of expenses that teachers can deduct starting this year from $250 to $500 and allow first responders to also deduct $500 in certain expenses starting in 2020.

To pay for the costs of those changes, the top individual tax rate would revert from 37% to 39.6%, and the threshold for that top rate would be lowered, from 2020 through the end of 2025, when the GOP tax law’s individual provisions expire.

A symbolic gesture? The cap was a controversial element of the 2017 Republican tax law, with Democrats in high-tax states such as New York, New Jersey and California objecting to a provision they said unfairly targeted their residents. The new legislation stands no chance of becoming law, but it gives Democratic lawmakers a chance to signal that they are working for constituents hit by the cap.

“The SALT cap hit my home state of New Jersey like an anvil from five stories up,” said Rep. Bill Pascrell, a Democrat, noting that the average value of New Jersey SALT deductions before the new law was nearly double the cap. “Imagine that hit, but spread out over millions of households from coast to coast. These are families in New Jersey, Illinois, New York, Minnesota, Kentucky, and Texas — all paying through the nose to fund a big business tax cut. And they not only lost a deduction they relied on, but also the services like education, infrastructure and public safety funded by SALT they depend on.”

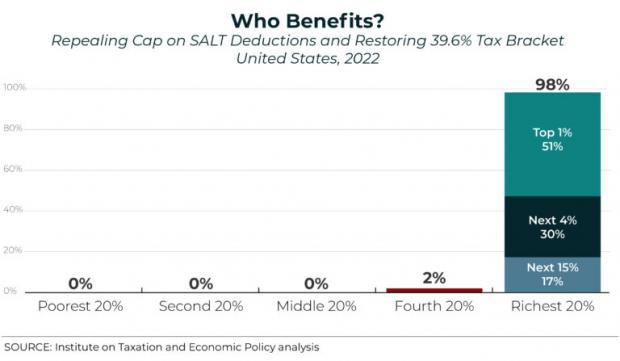

But Republicans, fiscal watchdogs and Democratic policy wonks countered that the SALT cap repeal would largely benefit the rich. As The Hill’s Naomi Jagoda notes, three left-leaning think tanks — the Center for American Progress, Center on Budget and Policy Priorities and Institute for Taxation and Economic Policy — all put out papers this week arguing that the Democrat’s bill would overwhelmingly benefit high-income households (see the papers here, here and here).

The bottom line: “Wednesday's vote was a rare instance of Democrats effectively fighting for tax cuts that would accrue to the rich, with Republicans in opposition,” the Washington Examiner’s Nihal Krishan wrote. But while the bill might pass if it gets a vote on the House floor, it has little chance of getting through the Republican-controlled Senate.