The 2017 Tax Cuts and Jobs Act cut the corporate tax rate to 21%, but a new analysis finds that many large businesses paid much less than that in 2018, the first year the law was in effect.

The Institute on Taxation and Economic Policy, a left-leaning, non-partisan think tank, analyzed the 2018 financial filings of 379 profitable businesses in the Fortune 500 and found that their average effective tax rate – the actual rate paid to the government – was just 11.3%. By comparison, the average effective tax rate for major firms between 2008 to 2015 was about 21%, ITEP said.

While effective rates are typically lower than statutory ones, since most companies take advantage of deductions, tax breaks and other loopholes to lower their tax rates, it’s notable the 2017 law left so many doors open to tax rate reduction. “When drafting the tax law, lawmakers could have eliminated special breaks and loopholes in the corporate tax to offset the cost of reducing the statutory rate,” ITEP said. “Instead, the new law introduced many new breaks and loopholes, though it eliminated some old ones.”

About $74 billion in subsidies: The 379 firms examined in the report claimed $73.9 billion in tax reductions, and half of that came from just 25 companies. The top three firms receiving tax subsidies were banks, with Bank of America claiming the most at $5.5 billion. Other major companies claiming big tax subsidies included Amazon ($2.4 billion), AT&T ($1.1 billion), General Motors ($1 billion) and Apple ($989 million).

Billions in missing revenue: “In 2018, the 379 companies earned $765 billion in pretax profits in the United States,” ITEP said. “Had all of those profits been reported to the IRS and taxed at the statutory 21 percent corporate tax rate, the 379 companies would have paid almost $161 billion in income taxes in 2018. Instead, the companies as a group paid just more than 54 percent of that amount.”

91 companies paid no tax: Dozens of firms paid no taxes, and some of those received refunds, effectively paying negative rates. The list includes many well-known companies, such as Amazon, Starbucks, Halliburton, General Motors, Delta Air Lines, Aramark and Whirlpool.

Industry variations: The report calculated tax rates for 22 distinct industry sectors and found that two industries – industrial machinery and utilities, gas and electric – paid negative tax rates in 2018. Seven sectors – including motors vehicles and parts; oil, gas and pipelines; and engineering and construction – were in the single digits, while four were at 20% or higher, including health care and internet services and retailing. Only one industry sector, pharmaceuticals and medical products, paid more than the statutory rate of 21%, paying 22% instead. A total of 57 companies across sectors paid more than the 21% rate overall, typically due to payments related to prior liabilities.

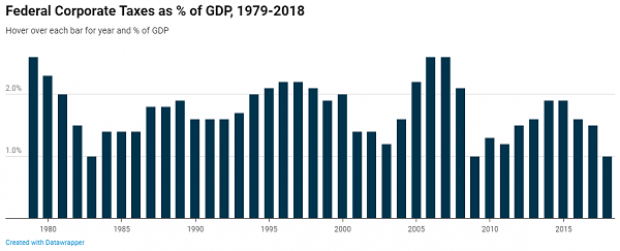

Revenues near record lows: Corporate tax revenues as a share of the economy are near record lows. “As the adjacent chart shows, overall federal corporate tax collections as a share of GDP have only fallen to 1.0 percent three times in the last 40 years,” the report said. “The first time was in 1983, at the nadir of President Reagan’s supply-side experiment. The second time was in 2009, when the Great Recession’s impact on tax collections was at its worst. And the last time was in fiscal 2018, the first year in which President Trump’s tax cuts were in effect.”

Both previous drops in revenues were reversed, ITEP said, the first by policymakers and the second by the economic recovery. This time around, higher revenues will likely have to come from tax reform. “Getting the nation’s fiscal house back in order will require increasing corporate income tax revenues,” the report concludes.