The aggregate balance of the hundreds of federal trust funds and other dedicated funds will start declining in two years, according to a new report from the Government Accountability Office.

Republican Senators Mike Enzi (WY) and Mike Braun (IN) asked the GAO to review the status of the funds that support Social Security, Medicare, flood insurance, and many other programs, and the results were published this week.

It’s a large and complex topic, as this passage from the GAO report makes clear:

“Hundreds of programs across the federal government are supported in whole or in part by a trust fund or other dedicated fund. Our analysis of OMB’s budget data shows 398 active federal trust funds and other dedicated funds in fiscal year 2018. Non-revolving trust funds and special funds make up the greatest number of these types of accounts and also hold the greatest total balances.”

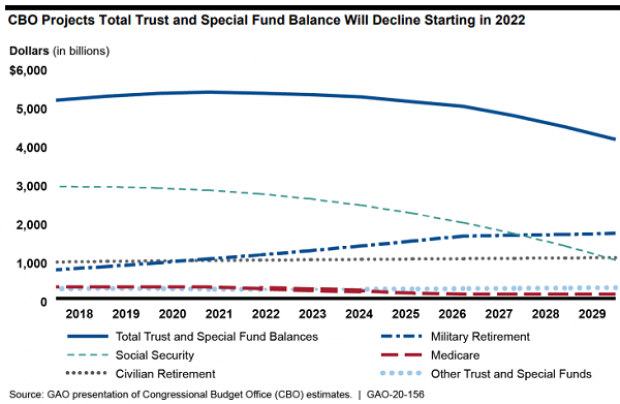

Overall, the balances in the trust funds increased between 2014 and 2018, the GAO found, but the aggregate balance will begin to fall in 2022, with decreases in the Social Security and the Medicare Hospital Insurance funds leading the way (see the chart below). The overall balance is particularly sensitive to Social Security, which has the largest trust funds by far, totaling $2.9 trillion in fiscal year 2018.

The report calculated depletion dates for some trust funds, including:

- By 2022, the Highway Trust Fund will be depleted. Projected revenues will fall short of obligations.

- By 2025, the Pension Benefit Guarantee Corporation multiemployer trust fund will be depleted. Projected revenues will fall short of obligations.

- By 2026, the Medicare Hospital Insurance Trust Fund will be depleted. Projected revenues will cover 89% of scheduled benefits.

- By 2034, the Social Security Old-Age and Survivors Insurance Trust Fund will be depleted. Projected revenues will cover 77% of scheduled benefits.

- By 2052, the Social Security Disability Insurance Trust Fund will be depleted. Projected revenues will cover 91% of scheduled benefits.

Lawmakers have several options available when trust funds run out, though each may have different legal requirements to enact. In general, they can use general revenues to cover any shortfalls, though this may involve additional borrowing; they can reduce outlays; they can transfer dedicated funds from other programs; or they can generate new revenues through taxes and levies.

“Program sustainability is ultimately determined by whether the government as a whole has the economic capacity to finance the claims on the trust funds at the cost of other competing priorities,” GAO said.

In a statement accompanying the release of the report, Enzi called on lawmakers to address the issue: “Congress will need to work in a bipartisan manner to safeguard these programs to ensure they are able to provide for those who need them now, and in the future.”