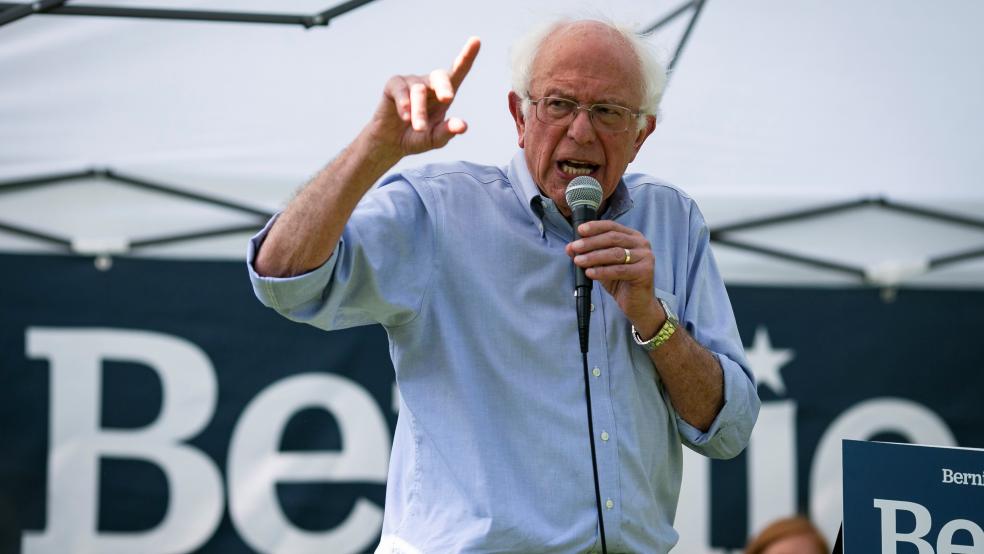

Sen. Bernie Sanders (I-VT) unveiled new legislation Thursday that takes aim at a tax break for retirement plans that benefit many highly paid executives.

The bill, which is co-sponsored by Sen. Chris Van Hollen (D-MD), “could dramatically alter compensation at major U.S. companies,” according to The Wall Street Journal’s Richard Rubin and Theo Francis.

The target: Some large companies allow top executives to defer compensation to a later date, with the aim of reducing their tax burden. Unlike conventional 401(k) retirement plans, there are no limits on the amount of money that can be deferred, providing highly compensated employees with a substantial potential tax break.

What the bill would do: The senators would tax compensation as soon as its vests rather than when it is distributed, a move they say could bring in $15 billion in federal revenue. The funds would be used to shore up the Pension Benefit Guarantee Corporation, which provides a safety net for private-sector pension plans.

What Sanders says: “It is outrageous that a corporate executive in America can get unlimited, special tax privileges on hundreds of millions of dollars in savings, while an ordinary worker can only get tax deferment of up to $19,500 on a 401(k),” Sanders said Thursday. “We are going to end these tax breaks for CEOs and use that money to protect 1.7 million workers who are worried about a decent retirement as they face instability in their current pension plans.”

Big numbers: The Sanders plan references a new study by the Government Accountability Office that looked at deferred payment plans for 2,300 top-level executives at the 500 largest publicly traded companies. The report found that the executives had more than $13 billion stashed in tax-deferred funds, with some CEOs sitting on more than $100 million.

Not a new idea: The bill is similar to a proposal backed by some Republicans ahead of the Tax Cut and Jobs Act in 2017, the Journal’s Rubin and Francis report, but that proposal was abandoned in the face of stiff resistance from CEOs. "Republicans and Democrats alike have called for ending these tax breaks, and it’s past time to get it done," Van Hollen said.