Millions of Americans — and many of our readers — are wondering what kind of check they’ll be getting from the Treasury as part of the emergency aid package that is expected to become law as soon as Friday. We’ve gotten some reader questions about who is or isn’t eligible for the payments and other details of the program.

Some basics:

Do you have to apply? No. The IRS is basing the payments on 2019 tax returns, or 2018 for those who have yet to file a 2019 return.

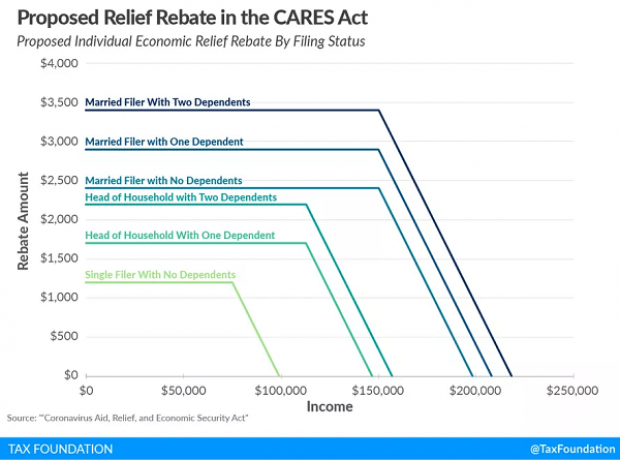

How much? For those who meet the income requirements, adults will receive $1,200 each, with an additional $500 per child. The Washington Post has a handy calculator you can use to determine how much you’ll get.

What are the income requirements? Adults who have Social Security numbers and are U.S. residents will receive the full amount if they earn up to $75,000 in adjusted gross income ($150,000 for couples). Someone filing as head of household would get the full amount if they earn $112,500 or less.

The payments are phased out at a rate of $5 for every $100 in income above those thresholds, with individuals making $99,000 or more ($198,000 for couples) not eligible.

How will the money arrive? The IRS will use direct deposit if it has the necessary information and send checks if it does not.

When will the money arrive? This is still an open question. Treasury Secretary Steven Mnuchin said the money would go out about three weeks after the bill becomes law, but Senate Minority Leader Chuck Schumer said he hopes the money will start flowing on April 6. Former IRS officials told Bloomberg News that both schedules are overly optimistic, and that the money could take about two months to arrive.

Can you show me a graph to make it easier? Thanks to the Tax Foundation, the answer to that question is yes: