Economists at Goldman Sachs say additional fiscal measures to support an economy battered by the coronavirus pandemic are likely to be necessary, and they expect those measures could add another $500 billion (2.4% of GDP) to this year’s deficit and up to $1.5 trillion (7% of GDP) over the next couple of years.

“We assume additional fiscal easing because the measures enacted to date, while substantial, are not yet equal to the lost income due to COVID-19 that we expect,” Goldman economist Alec Phillips wrote in a note to clients Monday.

While the next phase of congressional coronavirus relief is still in its early stages — and there are already signs that reaching consensus on that package may be difficult — Phillips suggests that Congress might need to provide more funding for small business loans, unemployment benefits and aid to state and local governments, with additional direct payments to individuals also possible. But, he suggests, those programs may not be as large as they were in the CARES Act signed into law late last month.

Phillips also throws come cold water on the possibility of a large infrastructure package, though he suggests a more modest program on the order of $50 billion to $100 billion might be included. “While it is true that there is bipartisan interest in infrastructure, the debate over the long-term program has been over how to finance it over the long-term and on this, the two political parties have not come much closer to an agreement,” he writes.

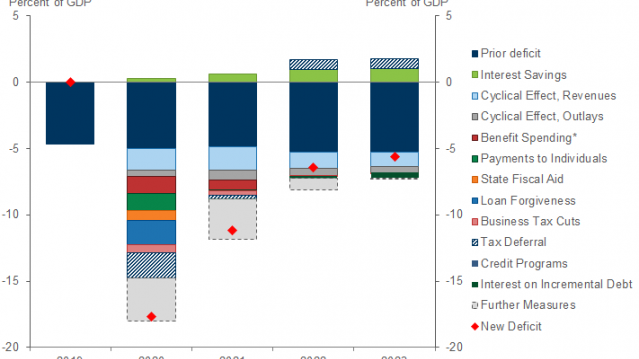

The deficit and debt effects: In all, Phillips projects, the various phases of coronavirus relief will raise the deficit to about $3.6 trillion (nearly 18% of GDP) this year and $2.4 trillion (11% of GDP) next year — a total increase of about $4 trillion over the two years.

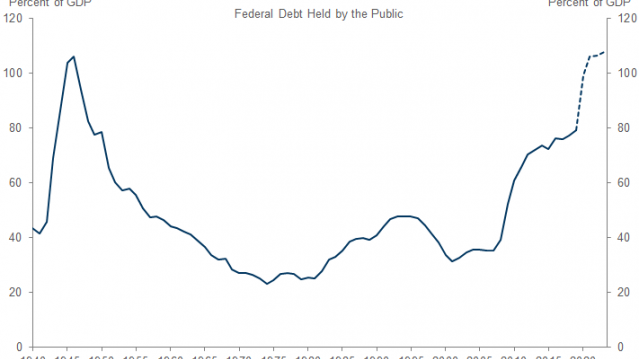

As a result, debt held by the public will rise from 79% of GDP last year to 99% by the end of this year and 108% by 2023, topping the previous high reached in 1946.