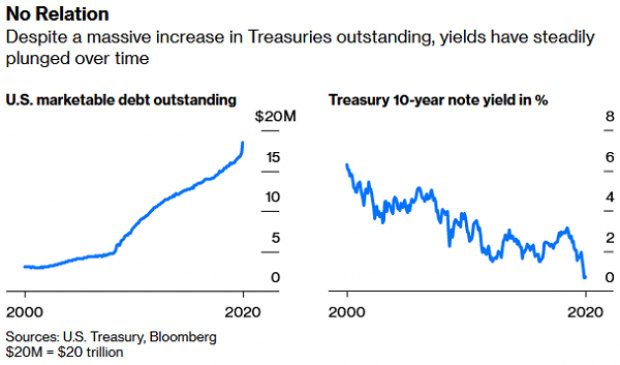

“Simple laws of supply and demand suggest that when there’s an abundance of something, the price of that thing falls,” says Jared Dillian at Bloomberg, before noting an apparent exception to the rule: “The bond market seems to have been the exception, with yields – which move inversely to bond prices - having steadily declined to next to nothing despite the amount of U.S. marketable government debt outstanding having risen to $18.5 trillion from less than $5 trillion before the financial crisis.”

Dillian speculated Tuesday about whether the enormous increase in the supply of Treasuries in the coming months will overwhelm demand, forcing interest rates higher – a “black swan” event that would have enormous implications for the cost of servicing the U.S. national debt. So far, though, as the chart below indicates, there are few signs of that happening, with interest rates remaining near record lows.