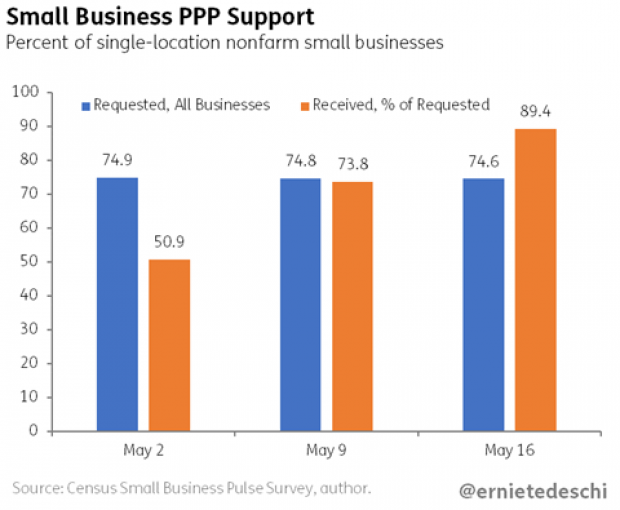

Although critics say the $670 billion Paycheck Protection Program, which provides small businesses with loans and grants during the coronavirus crisis, is seriously flawed, there’s no doubt that it has been wildly popular. Ernie Tedeschi of the research firm Evercore ISI says that, according to U.S. Census survey data, about 75% of all non-farm small businesses with single locations have applied for assistance through the program, and nearly 90% of those have received a check.

But many small business owners say that the PPP’s rules – which require participants to spend 75% of the funds on labor and use all of the money within eight weeks in order to transform the loans into grants that don’t have to be paid back – aren’t realistic and may leave some aid recipients with big loans on their books. The House passed a bill last week that would extend the time to use the money to 24 weeks while eliminating the requirement to use most of the money for labor costs.

The Senate was working on its own version of a revamp this week but was unable to reach a deal before leaving town Thursday, despite threats from Sen. Cory Gardner (R-CO) to keep the chamber open in the absence of an agreement. Senators were discussing an increase in the time period to use PPP funds to 16 weeks and an extension of the program, which is scheduled to expire on June 30, to the end of the year. Participants may also be allowed to use the funds for a wider range of expenses, including investments needed to reopen safely.

Although the Senate won’t be back in session until June, there is some hope that a bill could pass next week through special procedures. “I don’t think we’re going to have a problem getting something done one way or the other on it,” said Sen. Marco Rubio (R-FL), who leads the small-business committee.