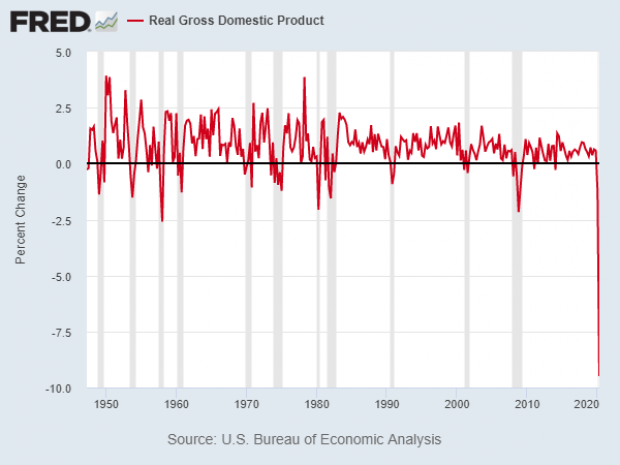

The U.S. economy in the second quarter shrank at the fastest pace on record by some measures, with gross domestic product falling by 9.5% on a quarterly basis as businesses closed and millions of Americans stayed home in response to the coronavirus pandemic.

On an annualized basis – the rate for the full year, assuming the quarterly results were repeated in each quarter – the economy shrank at a rate of 32.9%, the fastest since 1946, according to Deutsche Bank.

“The collapse was unprecedented in its speed and breathtaking in its severity,” The New York Times said Thursday. “The only possible comparisons in modern American history came during the Great Depression and the demobilization after World War II, both of which occurred before the advent of modern economic statistics.”

Although the numbers are shocking, they were not unexpected; economists polled by Dow Jones had expected to see a decline of 34.7%.

Mark Zandi, chief economist at Moody’s Analytics, said the report “highlights how deep and dark the hole is that the economy cratered into in Q2. It’s a very deep and dark hole and we’re coming out of it, but it’s going to take a long time to get out.”

The White House put a relatively positive spin on the report Thursday, with President Trump’s Council of Economic Advisers saluting Americans’ resiliency and the strength of the economy heading into the crisis. “The magnitude of this contraction reflects the gravity of the economic sacrifice Americans made to slow the spread of COVID-19 and prevent greater tragic loss of life and health,” the council said in a statement. “The country mitigated pressures on hospital capacity and allowed medical professionals the time to learn how to more effectively treat this disease. The Trump Administration will continue to support America as we build a bridge to the other side of this crisis.”

But that bridge is looking harder to cross as the size of the crisis – and the lack of recent progress (see new unemployment figures, below) – has come into sharper focus. “A couple of weeks ago there was a lot more optimism that we would see a strong V-shaped recovery,” Edward Moya, an analyst at currency trading firm OANDA, told Politico. Now, however, “there is a lot of bad news about how some areas are handling the virus. And every day we don’t have a new stimulus agreement in place is hurting the economy.”