The unemployment rate dropped to 7.9% in September, the Labor Department announced Friday, as total nonfarm payroll employment rose by 661,000 during the month.

But what under normal circumstances would be blockbuster job numbers were seen as a disappointment, falling well below expectations of 800,000 while providing fresh evidence that the recovery is losing momentum as fiscal support runs dry and the coronavirus continues to dampen economic activity.

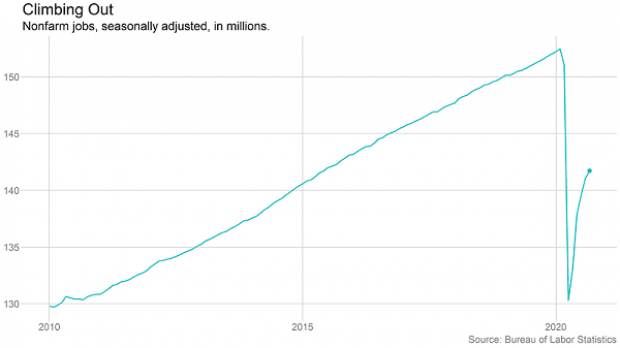

Job growth is clearly slowing, falling from 1.8 million in July and 1.5 million in August, raising new concerns about how long it could take to recover the roughly 22 million jobs lost in the coronavirus recession. The economy has recovered about half of those jobs so far, leaving the labor market nearly 11 million in the hole. Some economists now say it could take until 2022 or even 2023 to recover them all.

“The jobs number is positive, but it’s flashing warning signs,” Ernie Tedeschi of Evercore ISI told The Washington Post. “It’s decelerating fast, and that worries me. If jobs growth is slowing, it’s going to take us longer and longer to recover from this recession."

Some jobs aren’t coming back. The number of workers saying their jobs were gone for good rose from 3.4 million in August to 3.8 million in September. And the number of long-term unemployed rose by 781,000, the largest monthly increase on that variable since data collection began in 1948.

Labor force shrinks: The half a percentage point drop in the unemployment rate was impressive, but it fell not because there was such a surge in jobs but because so many people have given up looking for work, with the labor force participation rate falling by 0.3 points to 61.4%. Women were particularly hard hit, with more than 860,000 female workers leaving the labor force in September, the great majority of the 1.1 million who dropped out.

“A drop in participation is unequivocally bad for the labor market outlook,” said Wells Fargo senior economist Sarah House. “It has the potential to prolong the overall recovery as workers are more disengaged with the labor market.”

An “illusion of progress”: Nick Bunker, economic research director at the job search site Indeed, said the latest employment report is “massively concerning. We are not where we need to be, nor are we moving fast enough in the right direction as we head into fall.” The numbers provide “an illusion of progress at a time when we needed accelerating gains in the labor market. The number of jobs added this month is just not enough,” he said.

Hopes for more stimulus: The lack of additional fiscal support is a real concern, said Gus Faucher, chief economist at PNC. “The low-hanging fruit has been picked, and the job market recovery will slow further going forward,” he said. “A surge in coronavirus cases in late 2020 could lead to further business closures. An inability to pass additional fiscal stimulus — including aid to households, small and mid-size businesses, and state and local governments — is another downside risk.”

Mark Zandi, chief economist of Moody’s Analytics, said the report “is just proof positive that this is no V-shaped recovery. It’s going to be a slog. The economy risks stalling out without any additional fiscal support.”