Here’s a quick update on the debt limit standoff: Nothing much has changed.

Ahead of a White House meeting on May 9 between President Joe Biden, House Speaker Kevin McCarthy (R-CA) and the other congressional leaders, “Democrats and Republicans appear to be waiting for next week’s meeting to decide their next steps, and remain dug in on their respective positions,” The Washington Post reported this morning.

As the game of chicken continues, with each side trying to ramp up pressure on the other, the Post’s Jacob Bogage details five possible outcomes for the debt limit standoff. Here’s a brief overview:

1. Biden and McCarthy reach a deal. It’s not clear what this might look like or how it could be achieved, but a deal could also come with economic costs and lingering uncertainty if it means the debt limit has to be revisited within a couple of years.

2. Rank-and-file lawmakers make an end run around congressional leadership. A long shot.

3. Congress passes stopgap legislation to delay a default. “If lawmakers decided to, they could suspend the debt ceiling until the end of September,” Bogage says. “That would align a new debt ceiling deadline with another deadline: the budget. Congress must pass new spending bills by the end of September, or the government would partially shut down. That would allow policymakers to put all of these issues in one debate, but it would raise the stakes even more if they don’t act.”

4. The White House acts unilaterally to resolve the crisis. The White House has a couple of options for acting on its own to defuse the crisis: a trillion-dollar coin and invoking the 14th Amendment to the Constitution, which says, “The validity of the public debt of the United States … shall not be questioned.”

Neither option seems likely.

5. The United States defaults. This would be ugly.

The White House Council of Economic Advisers on Wednesday warned that a breach of the debt ceiling “would likely cause severe damage to the U.S. economy” and that a protracted default would likely lead to millions of job losses.

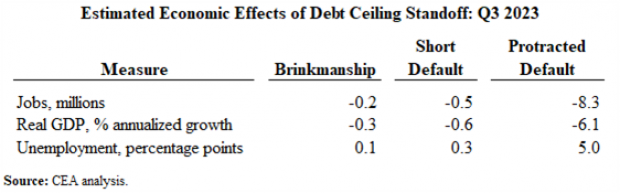

The White House report examined the potential results of three scenarios: brinkmanship, where default is ultimately averted; a short default; and a protracted default. Each would cause damage, according to the analysis, as summarized in the chart below. In the worst case, a protracted default would prompt “an immediate, sharp recession on the order of the Great Recession.” The stock market could plummet 45% and the unemployment rate would jump more than 5 percentage points as more than 8 million jobs are wiped out.

The deadline for raising the limit and avoiding such a catastrophe could be as soon as June 1, and it’s rapidly approaching in part because of better service by the IRS, Politico’s Brian Faler notes: “It’s not just weaker-than-expected tax receipts that are pushing up the drop-dead deadline for raising the legal cap on borrowing. It’s also that the IRS is processing people’s tax returns faster. Because of its newfound efficiency, the government will run out of money to service its debts earlier than it expected.”