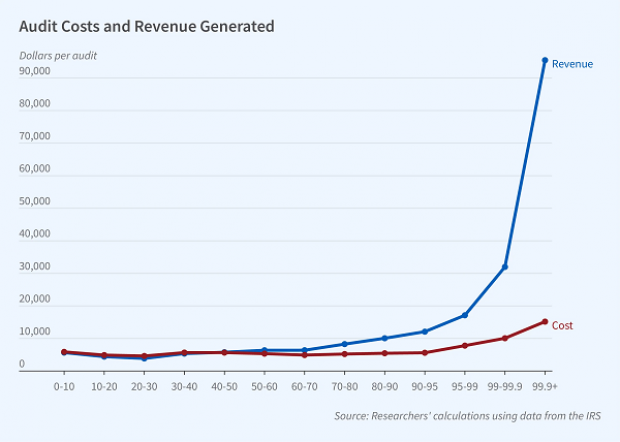

A recent paper published by the National Bureau of Economic Research provides further evidence that investing more resources in auditing capacity at the IRS provides a positive payoff for the federal government. Analyzing the results of in-person individual income tax audits between 2010 and 2014, researchers from the Treasury Department, Harvard University and the University of Sydney found that the average revenue produced by such efforts was $14,283, with an average cost of $6,418 – producing an “average revenue yield” of $2.17 per dollar spent by the IRS.

The return on audits of taxpayers in the 0.1% of the income distribution was markedly better, with each dollar spent by the IRS producing $6.29. Focusing on lower-income taxpayers was far less productive, however. Audits of those in the bottom 50% of the income distribution produced just 96 cents per dollar spent, making such efforts losing propositions.

“The findings suggest that putting more money toward IRS funding may be one of the most efficient ways to clip Washington’s blooming deficit, which, despite the growing economy, is expected to double this year thanks in part to unexpectedly weak tax revenues,” says Semafor’s Jordan Weissmann. “They’re also sure to be a talking point for Democrats looking to defend the IRS from attacks by Republicans in Congress, who have rallied around clawing back the agency’s funding. This year’s debt ceiling deal would already reduce the pot by $21 billion.”