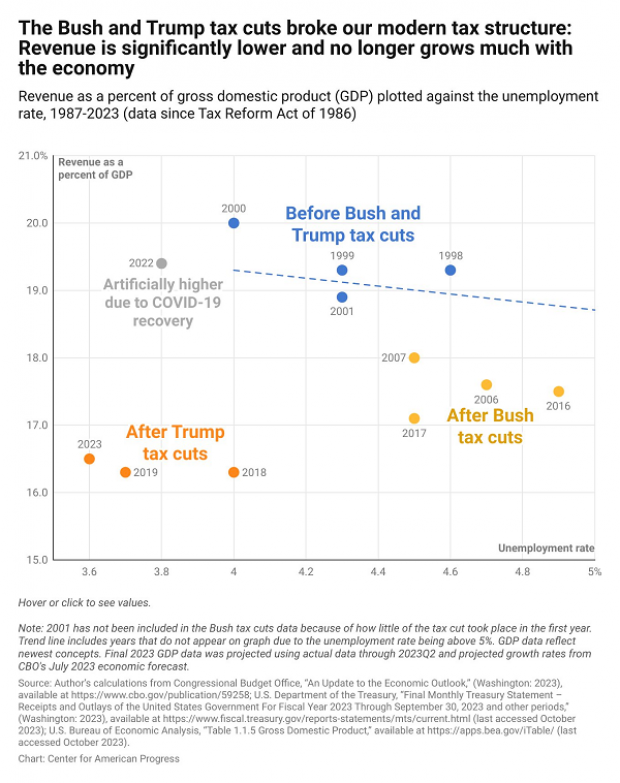

Historically, tax revenues have increased significantly during economic booms as unemployment falls and then declined during slowdowns as unemployment rises, but according to Bobby Kogan, senior director of federal budget policy at the liberal-leaning Center for American Progress, that dynamic is broken.

Writing at MSNBC Friday, Kogan argues that thanks to the tax cuts passed under Presidents George W. Bush and Donald Trump, revenues no longer rise very much even when the economy is booming. One result is that deficits have been expanding, with no sign of reversal.

“Prior to the tax cuts being enacted, the Congressional Budget Office projected long-term stability of the debt-to-GDP ratio,” Kogan writes. “Now, however, the CBO projects that debt is on track to rise as a percent of GDP indefinitely, with revenues now significantly lower and no longer projected to match primary (noninterest) program costs.”

Kogan says that during the late-‘90s economic boom, tax revenues grew from 17.9% of GDP in 1995 to 20% in 2000. Now, however, during 2023, a year of solid economic growth, tax revenues have been relatively stagnant at 16.5% of GDP.

Kogan’s chart below shows the change in the relationship between tax revenues and unemployment in the wake of the Republican tax cuts – a new weakness that has dire implications for the federal budget deficit. “If not for the regressive tax cuts initiated under presidents Bush and Trump, we would have been looking at a stable debt-to-GDP ratio,” Kogan writes. “Any discussion of how to change our fiscal path should focus first on generating additional revenue lost to these tax cuts.”