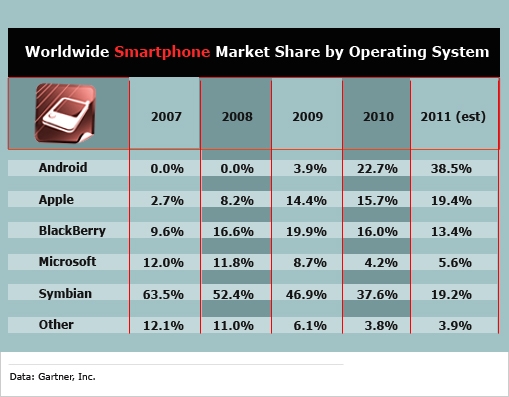

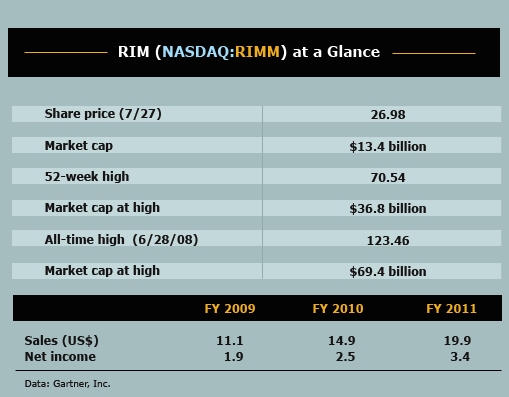

To be sure, all the recent news about RIM (NASDAQ:RIMM) has been bad. Its share of the worldwide smartphone market, as measured by Gartner, has fallen from a peak of 20 percent two years ago to 13.4 percent. Its stock has fallen to 25.15 from a 52-week high of 70.54 and its market cap stand at just over $13 billion, down from an all-time high of $123 billion. To top it off, the company just announced it would lay off 10 percent of its workforce.

Ugly as this situation is, though, RIM’s condition is not yet critical. The company remains profitable, with declining but still healthy margins. And its position remains strong in its core market of government, health care, and financial services, where its ability to deliver secure email and deployment of corporate application is more important than the glitzy features offered by competing products from Apple and Android.

To prosper, RIM has to remember who it is and what it does well. It’s confused identity was apparent when it introduced the PlayBook tablet early this year. This sleek 7” slate should have been brought to market as a BlackBerry companion for RIM’s core customers. As a standalone device, it is all but unusable because it lacks its own email, contact, and calendar apps; instead, it serves as a display for information stored on a linked (and nearby) BlackBerry.

This approach allowed the PlayBook to inherit BlackBerry’s built-in security and, it is the only tablet certified for use with unclassified government data under Federal Information Processing Standard 140-2. Unfortunately, it rendered the PlayBook thoroughly impractical for anyone who didn't already have a BlackBerry.

Nonetheless, RIM launched PlayBook with a consumer-oriented marketing campaign that focused on its video-playing capability. RIM failed to secure initial AT&T approval for the software that links the PlayBook to a BlackBerry, making it unusable until recently for about half of U.S. BlackBerry owners. More than three months after launch, the PlayBook is still painfully short on applications, with the promised native email program as well as such basics as Twitter and Facebook apps still missing.

Such botched execution is the sort of mistake RIM can no longer afford. The PlayBook is a solid piece of hardware design and its role in the world should be to promote RIM’s secret weapon, the BlackBerry Enterprise Server. BES is the back-end communications server whose security certifications and time-tested robustness give C-level corporate execs the confidence to trust it with their sensitive data. For all the talk of corporate IT depeartments being forced to support executives’ consumer devices, when security matters and when compliance with regulations such as the health Insurances Portability & Accoutnability Act is critical, BlackBerry still rules. These markets won't be engines of rapid growth, but they offer solid profits on fatter margins that the cutthroat consumer business.

Ultimately, RIM may have to consider leaving the hardware business altogether to concentrate on the more profitable service business, building software that lets BES applications run securely on other devices. This would not be easy for a company whose DNA is in hardware and whose co-CEO Mike La

zaridis is justly proud of RIM’s radio and power-management prowess. But with handset hardware increasingly commoditized (for everyone but Apple), it may be the best path to prosperity.