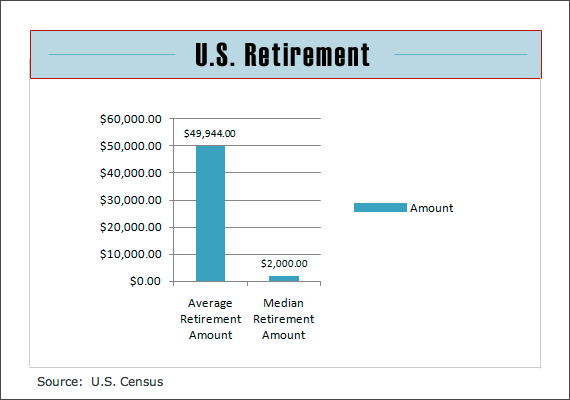

The Great Recession has thousands of aging Americans postponing retirement and watching their nest eggs dwindle. According to the Bureau of Labor Statistics, approximately half of all workers in the United States have saved less than $2,000 for retirement. But despite this crisis, some government employees are sitting pretty on nest eggs most public workers could only dream of.

For example, according to the Congressional Research Service, 290 members of congress who had retired under the Civil Service Retirement System as of October 2006 receive an average annual pension of $60,972. Not bad, but five-figure annuity is chump change compared with what some civil servants make each year. One California fire chief collects $436,691 a year -- a combination of his padded pension and school consulting income, while a former Congressman convicted of embezzlement collected $100,000 a year.

Many states worry that they’ll have to raid their funds to keep pension checks flowing to retired workers, making them vulnerable to further financial crisis. According to Boston College’s public plans database, in 2009, state employee pension programs were underfunded by a total of $708 billion. New York State, for example, is continuing to fully fund its pension program even as they slash overall spending and lay off nearly 10,000 employees.

As the war between the public and private sector heats up, take a look at some of the most lucrative pension plans around the country.