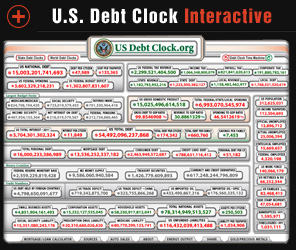

The U.S. national debt raced past the $15 trillion mark on Wednesday, providing added urgency to efforts by the Super Committee to try to reach agreement on a major deficit package before Thanksgiving.

The national debt rose by a startling $1.2 trillion over the past year, or the same amount that the bipartisan Super Committee is attempting to offset with a combination of spending cuts and revenue increases before next week’s deadline.

If the 12-member panel fails to reach an accord by next Wednesday, then last summer’s budget legislation calls for automatic cuts in defense and domestic programs totallinig $1.2 trillion beginning in 2013 – a scenario that lawmakers on both sides of the aisle say they oppose.

The soaring national debt – representing the cumulative U.S. borrowing from China, Japan and other creditors to keep the government operating – has been driven by a range of factors, including the impact of the economic downturn, credit card spending on two wars and the effects of major tax cuts.

While both parties share in responsibility for the debt problems, Republicans were quick to pounce on the new $15 trillion national debt figure to criticize the Obama administration.

House Budget Committee Chairman Paul Ryan, R-Wis., released a video on Wednesday blasting the Obama administration for mismanaging the economy and budget and calling the $15 trillion debt milestone an “infamous day in U.S. history.”

“Instead of advancing credible solutions, the President remains committed to more borrowing, more spending, and more taxes,” Ryan said in the video. “When it comes to making the tough decisions necessary to deal with our debt, the President is deferring to one commission after another, only to ignore the recommendations of these commissions.”

Texas Gov. Rick Perry, struggling to improve on his standing in the GOP presidential campaign, also weighed in. “This astounding debt is a heavy pair of cement shoes for our children and America’s economic future,” he said in a statement. Meanwhile Democrats continued to blame the administration of former President George W. Bush for policies that led to an historic financial crisis and recession.

Regardless of who is to blame, the bottom line is that the national debt is running at an alarming clip, with no sign of a let up in its growth. In just one year, the debt jumped from $13.8 trillion to $15 trillion, and the U.S. is on track to spend $1.3 trillion more than it takes in during the current fiscal year.

That amounts to nearly $48,000 in shared debt for every U.S. citizen and just over $133,000 for every taxpayer, according to Treasury figures.

Last August, Congress reluctantly agreed to raise the debt ceiling – the Treasury’s borrowing authority -- by around $2 trillion to a new total of $17 trillion provided Congress slashed about $2 trillion in deficit spending by 2021.

The ratio of U.S debt to the gross domestic product is 85 per cent, the highest level since 1950. By comparison, Germany has nearly 75 per cent debt to GDP ratio and Canada has 81 per cent. Japan ranks first with 194 percent.