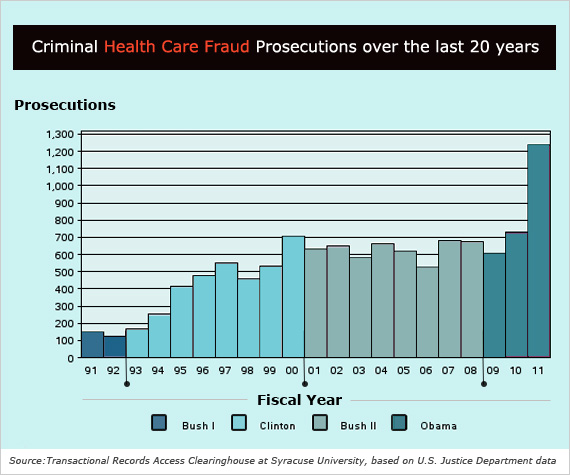

Federal prosecutors brought a record number of cases of health care fraud in fiscal 2011, a new report said, with Florida and its huge Medicare-dependent population remaining the epicenter of fraudulent claims.

The latest data, drawn from federal records by the Transactional Records Access Records database at Syracuse University, showed total prosecutions jumped 68.9 percent to 1,235 cases compared to 2010, a record increase.

The huge increase was fueled largely by a sharp jump in cases brought in Puerto Rico, where prosecutors charged 548 defendants with health care fraud last year, up from just 119 the previous year. Most of those were minor cases. But even without the Puerto Rican cases, fraud prosecutions nationwide were up sharply and reached the highest level since 2000.

Miami led the nation in activity, accounting for nearly one out of every nine health care fraud prosecutions, followed by Houston. Together, federal prosecutors in those two districts accounted for over one out of every five health care fraud prosecutions.

there’s lots of prosecutions.

The bad news is there’s

lots of prosecutions.”

The Obama administration stepped up its enforcement activity in late 2009 with the creation of tasks forces in nine cities to root out Medicare and Medicaid fraud. “They’re really going after these cases very aggressively, and I think you’ll see prosecutions increase even more over the next few years,” said Louis Saccoccio, chief executive officer of the National Health Care Anti-Fraud Association, which was launched in 1985 by insurers to help root out both private and public sector fraud in the industry.

“The good news is there’s lots of prosecutions,” he said. “The bad news is there’s lots of prosecutions. The real question is what will CMS (the Center for Medicare and Medicare Services) do to prevent these frauds from taking place in the first place.”

A typical case concluded in Trenton last week when a federal judge sentenced a former senior manager of Columbia, Md.-based Maxim Health Care Services, one of the nation’s leading home health care providers, to five months in prison for setting up a phony office that billed Medicaid and the Veterans Administration nearly a million dollars. The criminal charges were part of a nationwide investigation of Maxim that led in September to an out-of-court settlement where the firm – to avoid a conviction that might have disqualified it from the programs – agreed to pay the government $150 million in criminal and civil penalties.

Experts and even defense attorneys say health care fraud, estimated to cost the government $70 billion a year, won’t be curbed until the government figures out how to short-circuit schemes through better monitoring of claims before they are paid and better screening of firms before they are allowed to sell services to the programs. Last June, CMS launched a data-mining program that will review Medicare claims before payment to identify individual providers that show huge spikes in activity. “CMS is on the right track,” Saccoccio said.

“They have to blow up the bill now, investigate later system,” agreed Andrew Ittleman, a white collar criminal defense attorney at Fuerst Ittleman in Miami. While he says that many cases involve companies in legitimate billing disputes with the government, he agreed “it’s not at all misguided given the size of the problem and the magnitude of the fraud.”

“The more sinister cases down here involve people who set up broom closets without an address and bill Medicare as long as they can before they high-tail it to Cuba or wherever in Latin America,” he said. “Magistrates aren’t even giving pre-trial release to some of these defendants because we don’t have an extradition treaty with Cuba.”