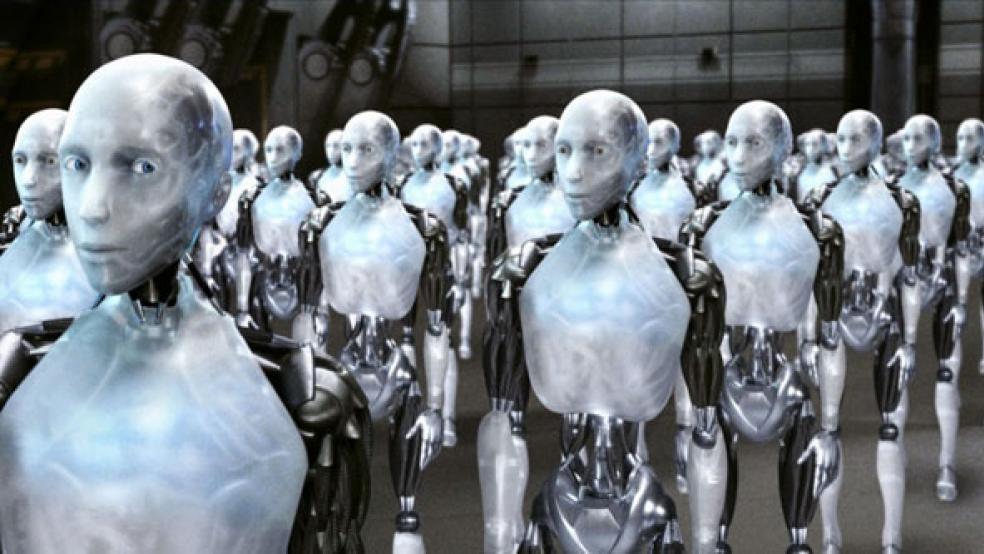

Paul Krugman has recently taken a keen interest in the rise of robots and automation — an issue that I have been focusing on since the publication of my book on this subject back in 2009.

In a recent post, Krugman says the following:

Smart machines may make higher GDP possible, but also reduce the demand for people — including smart people. So we could be looking at a society that grows ever richer, but in which all the gains in wealth accrue to whoever owns the robots.

I think there is a fundamental problem with this way of thinking: as jobs and incomes are relentlessly automated away, the bulk of consumers will lack the income necessary to drive the demand that is critical to economic growth.

RELATED: The Rise of Robots - and Decline of Jobs - Is Here

Every product and service produced by the economy ultimately gets purchased (consumed) by someone. In economic terms, “demand” means a desire or need for something – backed by the ability and willingness to pay for it. There are only two entities that create final demand for products and services: individual people and governments. (And we know that government can’t be the demand solution in the long run). Individual consumer spending is typically around 70 percent of GDP in the United States.

Of course, businesses also purchase things, but that is NOT final demand. Businesses buy inputs that are used to produce something else. If there is no demand for what the business is producing, it will shut down and stop buying inputs. A business may sell to another business, but somewhere down the line, that chain has to end at a person (or a government) buying something just because they want it or need it.

This point here is that a worker is also a consumer (and may support other consumers). These people drive final demand. When a worker is replaced by a machine, that machine does not go out and consume. The machine may use energy, resources and spare parts, but again, those are business inputs—not final demand. If there is no one to buy what the machine is producing, it will get shut down. Think of on industrial robot being used by an auto manufacturer. The robot will not continue running if no one is buying cars.*

So if we automate all the jobs, or most of the jobs, or if we drive wages so low that very few people have any discretionary income, then it is difficult to see how a modern mass-market economy can continue to thrive. (This is the primary focus of my book, The Lights in the Tunnel).

There is plenty of evidence that consumers are already struggling with the structural shift occurring in the economy. The years leading up to the current economic crisis were, of course, characterized by people consuming on the basis of debt rather than income. A just-released report shows that an ever increasing number of Americans are raiding their retirement accounts to pay current bills.

Does Paul Krugman really believe that it is possible to have a “society that grows ever richer” while a tiny number of robot owners hoover up more and more of total income — and the jobless masses consume the output by running up their credit cards or cashing in their 401(k)s?

The point is that the robot revolution is not just about income inequality. It will ultimately impact the sustainability of economic growth.

Innovation requires the existence of a market. New ideas will not receive the necessary backing if investors do not anticipate healthy market demand. A future with a dearth of viable consumers will be a far more zero-sum future. It will mean less of the type of innovation we associate with Steve Jobs — and more of the type you would find at Goldman Sachs.

RELATED: 10 Jobs That Won't Be Taken By Robots...Yet

One of the main points I make in my book is that I think we will ultimately have to treat the market itself as a kind of renewable resource. Jobs and wages have historically been the primary mechanism that redistributes income (and purchasing power) from producers back to consumers. Widespread reliance on robots and automation may ultimately cause that mechanism to break down — and that will be a threat to continued prosperity.

So what is the solution? In the long run, I think there will be no alternative except to implement direct redistribution of income. One possibility is a guaranteed minimum income funded by more progressive taxes (on the robot owners), and possibly by other sources (for example, a carbon tax).

It goes without saying that implementing such a solution would be an enormous social and political challenge. And it will intertwine with the other major problems we face. Meaningful action on climate change, for example, will become even more difficult in world where much of the population is increasingly focused on individual income continuity.

Make no mistake, responding to the impact that accelerating technology has on the job market could turn out to be one of the defining challenges for our generation.

* Not all robots are used in production, of course. There are also consumer robots. If you own a toy robot, it may “consume” batteries. However, in economic terms, YOU are the consumer — not the robot. You need a job/income or you won’t be able to buy batteries for your robot. Robots do not drive final consumption — people do.

Martin Ford is the author of The Lights in the Tunnel: Automation, Accelerating Technology and the Economy of the Future and has a blog at econfuture.wordpress.com.