After years of belt tightening and hand-wringing over revenue shortfalls, many states have a new challenge: figuring out what to do with revenue windfalls.

Governors and state legislatures across the country are scrambling to lay claim to ample budget surpluses that haven’t been seen since the start of the financial crisis and recession in 2007. The National Association of State Budget Officers projects that almost all states will see "fairly decent surpluses" in their 2014 budgets, with billions of more dollars pouring into their coffers than in previous years.

Related: Gov. Jerry Brown Uses Surplus to Prevent Bankruptcies

With an eye to the November elections, many governors and state lawmakers are eager to siphon those funds into popular causes – ranging from tax relief to restoration of spending cuts in important social programs, to fixing potholes to paying down long-term debt and unfunded pension liabilities.

The election could become a referendum on spending and tax policies as the economy improves. Total state tax revenues were up by 8.6 percent in the first quarter of 2013 compared to the same period in 2012, according to a report from the Rockefeller Institute of Government. In 39 states, tax collections were above peak levels for the first quarter of 2008. Revenues tapered off a bit during the remainder of the year, resulting in an overall annual rise of 5.7 percent.

While state capitals from Sacramento, Calif., to Albany, N.Y. to Tallahassee, Fla., are awash with politicians’ ideas for how to use those surplus funds, here are five Fiscal Times suggestions for ways to put those surpluses to good use.

Related: Why Smart Leaders Would Fix Our Infrastructure Now

Create an infrastructure loan guarantee fund. The fact that the nation’s roads and bridges are crumbling is well-known and documented. Despite repeated requests from the Obama administration, the federal government has failed to take any significant action on infrastructure improvement for the past several years. But states sitting on surplus funds could make it much easier for cities and local jurisdictions to take on infrastructure improvement projects themselves.

One way would be to dedicate surplus funds to an infrastructure loan guarantee program, which can be used to leverage a relatively modest amount of funding into a much larger amount of spending. The guarantee fund would promise to make lenders whole in the event of a borrower default, which in turn means that lenders will make loans at a lower interest rate.

Infrastructure loan guarantees have a long history, and through federal programs such as the Transportation Infrastructure Finance and Innovation Act, have supported projects nationwide. Many states currently capitalize State Infrastructure Banks with federal funding, but there is no reason additional loan guarantee programs could not be launched with state funds.

Related: A Double Hit for the States: Recession + Federal Cuts

Mental health and substance addiction treatment – This area has long been a stepchild of the U.S. health care system. While the nation spends $2.6 trillion annually on physician care, hospitalization, surgery and pharmaceuticals, only a small fraction goes to treating Americans who suffer from psychological and mental problems as well as drug and alcohol addiction.

Public and private mental health spending totaled about $150 billion in 2009, more than double its level in inflation-adjusted terms in 1986, according to Health Affairs. But the economy also nearly doubled in that time. Direct mental health spending has remained roughly one percent of the economy since 1986, while total health spending climbed from about 10 percent of GDP in 1986 to nearly 17 percent in 2009, according to a New York Times analysis.

A few states have a good track records in funding mental health programs, but many others don’t. And those states will have a long way to go to recover from an estimated $4.6 billion of cuts in state mental health programs over the last few years. Shifting some of the surplus to mental health and addiction programs would be an important step in that direction.

In recent weeks, Republican and Democratic governors alike have announced new community behavioral health funding initiatives, typically ranging between $5 million and $20 million.

Related: A New Push to Boost Spending on Mental Health

In Michigan, for example, Republican Gov. Rick Snyder said he will seek $5 million in new funding for mental health services to identify young people with mental health needs. Michigan has cut $124 million from community mental health programs since 2004. In Missouri, Democratic Gov. Jay Nixon is proposing $10 million in new mental health funding, primarily for a hospital emergency room diversion program. Eighteen months ago, a woman’s death in a St. Louis jail after she was refused mental health treatment in a hospital emergency room drew national attention.

Bolster underfunded pension programs. According to data compiled by the U.S. Census Bureau, in 2012 pension funds administered by the 50 states were underfunded by a cumulative $4.1 trillion. While no state is teetering on the edge of bankruptcy at the moment, the story of the city of Detroit, which is fighting in court to get out from under massive unfunded pension obligations, ought to be an object lesson.

According to the Census Bureau, not a single state has a fully-funded program, and the vast majority (excluding only Wisconsin, North Carolina, South Dakota, and Tennessee) are funded at less than 50 percent of their liability. California’s fund, by far the largest, is funded at 42 percent of its total obligations, but remains $641 billion shy of being fully funded. Illinois, the state with the worst funding level, at just 24 percent, is $287 billion in the hole.

The nice thing about pension obligations is that they are extremely predictable and are therefore easy to plan for. The bad thing about them is that they don’t go away. The bill is coming due, and states ought to dedicate some of their surpluses to making sure they will be able to pay it.

Tax Relief – With Congress and President Obama deadlocked over economic and tax proposals that might speed up the economic recovery, the states must examine ways they can step in to spur growth and job development.

Related: With Budget Deal Done, Ryan and Murray Eye Tax Reform

Not surprisingly, Republicans are far more inclined than Democrats to use a big chunk of the projected budget surpluses for tax cuts. Gov. Snyder’s budget director in Michigan predicted that an additional tax cut is "inevitable" in light of a roughly $1 billion surplus. Wisconsin’s Republican Gov. Scott Walker might press for tax cuts to help his reelection campaign.

He pledged while campaigning in 2010 to create 250,000 jobs, but he is less than halfway to that mark – and tax cuts might provide a further boost to the state economy. Big tax cuts also are on the agenda in Florida and Missouri, where budget surpluses are expected, according to an Associated Press survey. "If we put a tax-reduction package in place, I believe long-term we're going to grow our budget and grow our economy," Missouri Republican House Speaker Tim Jones said.

Some Democratic governors facing re-election also are proposing to roll back recent tax hikes.

Democratic Minnesota Gov. Mark Dayton wants to devote half of an $825 million surplus toward cutting taxes for the middle class and repealing new taxes on business transactions – although Democrats in the state legislature are opposing that move.

Invest in early childhood education. Just as physical infrastructure is vital to economic growth, a solid intellectual infrastructure is essential to an individual’s growth and development as a productive member of society. There is clear and convincing evidence that children who receive quality education in the years before they begin kindergarten perform better on a wide array of achievement measures later in life.

“Economists of all political stripes agree that quality preschool for children in low-income households returns positive net benefits over the life of the child,” former White House economist Jared Bernstein recently wrote in The New York Times.

President Obama has called on Congress to increase federal funding for early childhood education, but with little success. States sitting on budget surpluses could do much worse than to invest that money in their children’s’ future.

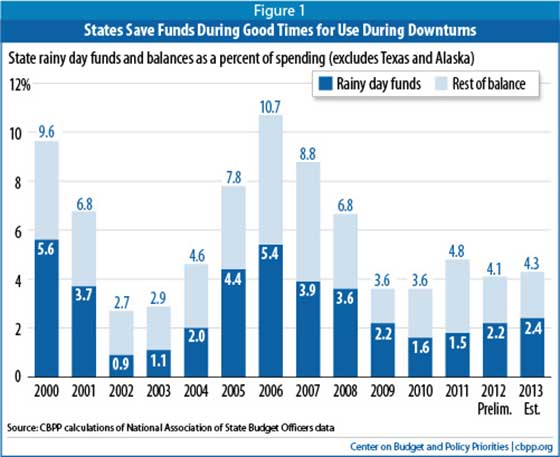

Replenish the Rainy Day Funds. It’s always smart to put something away to meet unexpected expenses, and historically, most states have tried to do that by creating so-called “rainy day” funds. But in the years following the financial crisis, many of those funds have been severely depleted. According to the Center on Budget and Policy Priorities, in the year before the financial crisis, the average state had a rainy day fund balance of approximately 5.4 percent of its total budget. By 2011 that had plummeted to 1.5 percent.

In 2012, states began restoring money to their rainy day funds, but at 2.2 percent, they remain at less than half their pre-crisis levels.

Top Reads from The Fiscal Times: