One of the reasons why members of Congress are reluctant to wade into the swamp of tax reform legislation is that any such proposal inevitably creates a lot of winners and losers. And, there is often little political benefit for the politician sponsoring the bill. “The losers are going to complain loudly, and the winners are diffuse aren’t going to celebrate too much,” said Jonathan Traub, managing principal of the tax policy group at Deloitte Tax.

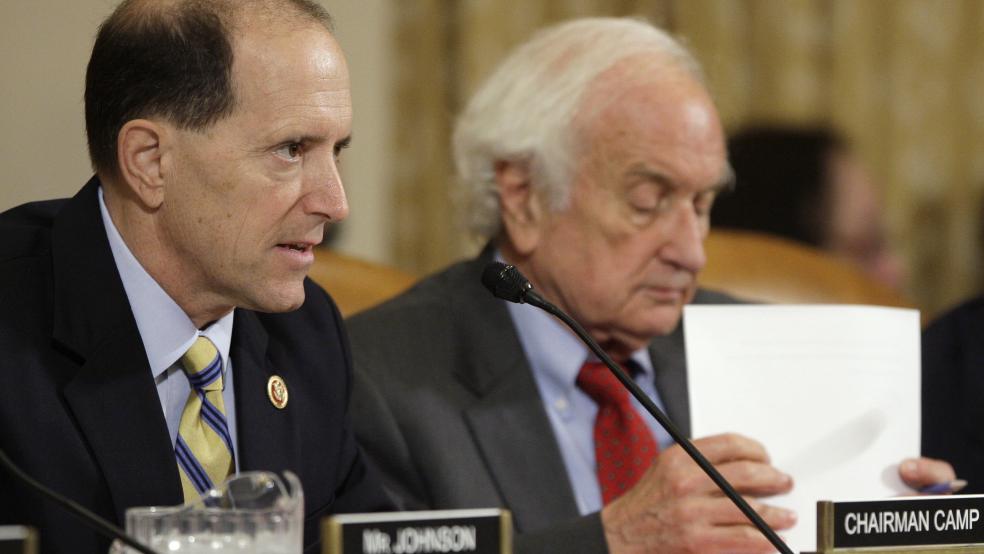

Despite the political peril, Rep. Dave Camp on Wednesday released a sweeping proposal to reform the tax code. The most dramatic change in his plan is the reduction of seven tax brackets to two—10 percent and 25 percent for all taxable income. Here’s a list of the folks who will be complaining the loudest on some of the other changes, and those who will be quietly congratulating themselves.

Related: Camp’s Courageous Tax Plan Is Bashed by All Sides

Losers:

| Loser | Reason |

|---|---|

| EITC Recipients | The Earned Income Tax Credit will be significantly less generous, though says other changes could offset the changes. |

| Jetsetters | Companies with corporate jets would have their wings clipped by the plan’s elimination of a tax break creating special depreciation rules for jets. |

| Big Banks | Large financial firms – specifically those classified as “systemically important” under the Dodd-Frank Act – would face a new “excise tax” based on their consolidated worldwide assets. |

| H&R Block | Tax preparation firms can’t be thrilled that 95 percent of filers will no longer need to itemize their deductions to get their maximum refund. The 1040EZ just got easier. |

| Fund Managers | Hedge fund and private equity fund managers would no longer be able to classify the “carried interest” payments they receive as investment income; the money would be taxed at the higher rate reserved for regular income. |

| Video game creators | The Camp proposal makes a research and development tax credit permanent for most businesses, but specifically bars the makers of “violent” video games from taking advantage of it. |

| Nick Saban | A 25 percent excise tax is imposed on compensation in excess of $1 million paid by a tax-exempt organization to one of the top five highest paid employees. Nick Saban—welcome to the NFL. |

| Divorced people | Alimony payments will no longer be tax deductible. |

| Taxpayers in High Tax States | The Camp plan repeals the deduction of state and local income, property, and sales taxes. |

| The NFL | The proposal repeals the existing tax exemption for professional sports leagues. (Okay, not just the NFL – but paying Commissioner Roger Goodell $30 million might have brought this on.) |

| Renewable Energy | Camp would eliminate tax breaks targeted specifically at alternative energy firms. |

| Future homeowners | The mortgage interest deduction is capped at $500,000. |

| Taxpayers | Deductions for state and local taxes are no longer allowed. |

Winners:

| Winner | Reason |

|---|---|

| Seniors | The proposal would create a simplified tax form for individuals over 65 receiving typical forms of retirement income. |

| Parents | Under the Camp proposal, the child tax credit grows to $1,500 and is indexed to inflation. |

| Charities | The reforms preserve deductions for charitable giving, and extend the tax year to April 15 for purposes of calculating donations. |

| Researchers | The proposal makes the Research and Development tax credit permanent. (Unless you make violent video games.) |

| Drivers | Camp would bail out the Highway Trust Fund, which is approaching insolvency, with an infusion of $126.5 billion over a decade. |

| Corporations | The corporate income tax would be slashed from 35 percent to 25 percent. |

| Current Homeowners | The plan preserves the mortgage interest deduction for all current homeowners, but phases it out for expensive homes purchased in the future. |

| Individual Investors | Camp would treat investment income as regular income rather than capital gains, but would exempt the first 40%, representing a net gain for investors. |

| Students | The proposal consolidates the tax code’s confusing maze of education benefits down to five streamlined programs. |

| Medical Device Manufacturers | The tax on medical devices, which was created to help pay for the Affordable Care Act, would be eliminated. |

| The Disabled | A new tax break would make it less expensive for businesses owners to make their places of work handicapped-accessible. |

| The Taxpayers | The AMT is eliminated permanently. |

Top Reads From The Fiscal Times: