Listen up, Class of 2018. Despite all the troubling job market trends you’ve likely heard about and the nagging uncertainties you may still harbor as you begin your college career — at least after that hangover wears off — the degree you’ve just started working toward will be worth around $300,000, according to researchers at the Federal Reserve Bank of New York.

Related: How Extended Unemployment Myths Hurt Millions of Jobless Americans

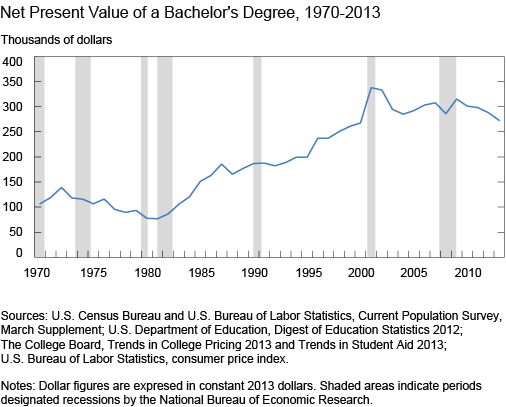

“Tuition costs have been rising considerably faster than inflation, student debt is mounting, wages for college graduates have been falling, and recent college graduates have been struggling to find good jobs,” Jaison R. Abel and Richard Deitz wrote in a four-part blog series last week. Despite those trends, though, they found that “the value of a bachelor’s degree for the average graduate has held near its all-time high of about $300,000 for more than a decade.”

The economists got to that figure by estimating the “average” benefits and costs of a college degree, using the wages a college graduate can expect to earn over a lifetime of work and comparing that with the average tuition and fees paid by undergraduates and the estimated wages the students would have earned with only a high school diploma.

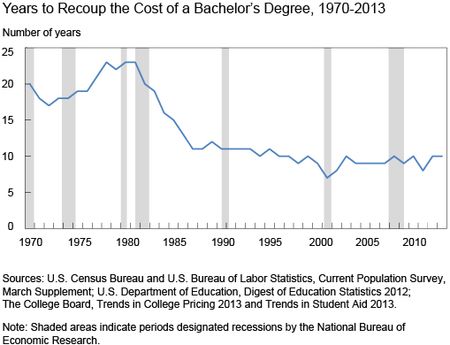

Measured another way, the economists say it takes about 10 years to recoup the costs of a bachelor’s degree, a historically low level down from close to 25 years in the late 1970s and early ‘80s. “So despite the challenges facing today’s college graduates,” they write, “the value of a college degree has remained near its all-time high, while the time required to recoup the costs of the degree has remained near its all-time low.”

Related: The Job Market’s Hot Streak Is Over…

That value still exists despite the rising cost of tuition, the dramatically increased levels of student debt and a depressing trendline in wages for college grads — but it’s primarily because wages for high school grads have fallen, too. As the authors put it: “the value of a college degree has remained high over the past decade in large part because of the declining fortunes of those without one. Thus, while the challenges recent graduates have faced in finding a good job might mean that that a college degree will not be as lucrative as it once was, having one is likely to remain better than the alternative.”

Even so, the researchers find that college isn’t necessarily a good financial investment for everyone. Based on the data, they find that “perhaps a quarter of those who earn a bachelor’s degree pay the costs to attend school but reap little, if any, economic benefit.” On top of that, the job market for college grads has still not completely recovered. “All in all, while finding a job has become easier for recent college graduates over the past few years, finding a good job has not, and doing so is likely to remain a challenge for some time to come,” the economists write.

The cost-benefit analysis for a college degree also shifts considerably when students take five or six years to get their diplomas instead of just four. “In addition to giving up one or two years of college-level earnings while in school, students miss out on a year or two of experience and the extra push that gives their wages over their working life,” the economists explain. “All in all, an extra year of staying in school costs more than $85,000, and for those who take two extra years to finish, it costs about $174,000.”

So, Class of 2018, get back to those books.

Top Read from The Fiscal Times: