|

The U.S. economy may have escaped another Great Depression, but the U.S. housing market has not been so lucky. From peak levels five years ago, home prices are down more than 30 percent, combined sales of new and existing homes are nearly 40 percent lower, and new home construction has plunged more than 70 percent. The road to recovery contains plenty of obstacles, including sluggish labor markets, restrictions on mortgage lending, and potentially damaging unknowns about U.S. fiscal policy and the European debt crisis. However, several factors are falling into place that will support gradual progress in the coming year as long as the economy doesn’t tip back into recession.

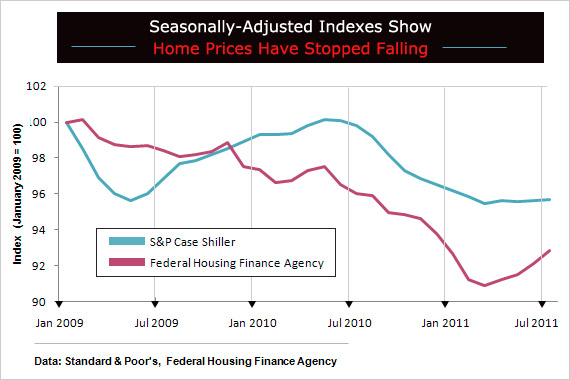

Most important, analysts increasingly believe that 2011 will mark the bottom in home prices. Most national price indexes adjusted for seasonal influences have stopped falling on a month-to-month basis. Reports this week, including the popular Standard & Poor’s Case Shiller home-price index on Tuesday, are expected to continue that trend. Breaking the deflationary psychology of recent years, which has kept some buyers on the sidelines waiting for further price declines, is a key to stronger demand, say economists at UBS.

News reports typically spotlight the year-to-year change, and most indexes show prices down about 3-to-4 percent from a year ago. However, those comparisons are somewhat misleading. Last year at this time prices were temporarily boosted by extra demand created by the homebuyer tax credit. After the credit expired last year, sales crashed and prices retreated, leaving this year’s year-over-year price changes looking weak compared to last year’s inflated levels. In coming months, UBS calculates, even if monthly changes remain at zero, year-over-year comparisons will stabilize by early 2012 and begin to turn modestly positive.

Downward pressures on home prices from both the demand and supply sides of the market are easing, but very slowly. On the supply side, the National Association of Realtors (NAR) in September counted 3.5 million unsold homes listed on the market. At the current sales rate, it would take 8.5 months to sell that inventory, down from a peak of nearly 11 months three years ago but about double the pre-recession supply. Plus, CoreLogic counts another 1.6 million unlisted units in the shadow inventory, which include properties that are 90 days or more delinquent on their mortgage, those in foreclosure, and real estate owned by the bank.

The good news is that the shadow is waning from a peak of two million units in January 2010, as distressed properties are being sold faster than new units are becoming delinquent. The bad news is that distressed sales account for about 30 percent of all home sales, and they occur at deep discounts, adding to the downward pressure on prices. CoreLogic chief economist Mark Flemming says that price weakness, negative equity, and weak job markets threaten to keep the shadow inventory elevated for a long time, a major headwind for prices.

However, regional differences show that the headwinds against overall prices are easing. Economists at Barclays Capital note that markets with fewer foreclosed properties have seen year-to-year increases in prices in 2011, while those with a higher concentration of foreclosures continue to post declines. CoreLogic, which looks at national prices with and without distressed sales, says overall prices in August were down 4.4 percent from a year ago, but excluding distressed properties, prices were down only 0.7 percent, reflecting yearly price increases in 26 states.

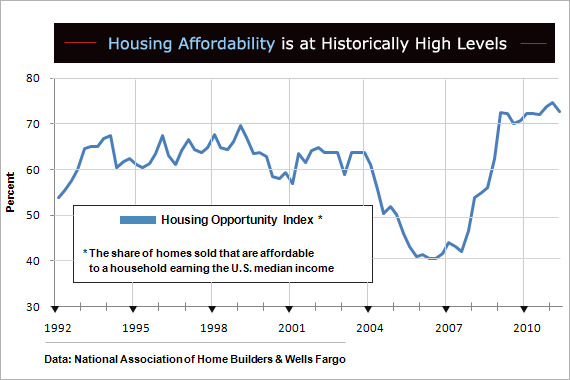

The demand side of the housing outlook is something of a paradox. Attractive home prices and super-low mortgage rates have made homes the most affordable in the postwar period. Yet, demand continues to languish. Sales of existing homes fell 3 percent in September and have mostly bounced around the current level this year. NAR chief economist Lawrence Yun says that despite historic affordability and more credit-worthy borrowers, the share of contract failures is double that in September 2010. Cancellations last month were reported by 18 percent of NAR members, says Yun, up from 9 percent last year.

The higher rate of contract failures mainly reflects unusually tight terms and conditions on mortgage lending, says the NAR, including declined loan applications, appraisal values coming in below the negotiated price, and other problems involving home inspections or job loss. In addition, higher loan limits for conventional mortgages established three years ago expired on Sept. 30, meaning that loans on many higher-priced homes now become so-called jumbo loans and carry a higher interest rate. The Senate voted to raise the limit on Oct. 20, but House passage is uncertain.

Tight loan standards and weak job markets in recent years have sharply reduced people’s willingness and ability to start a household, which continues to weigh heavily on home demand. Since 2006, the rate of household formation has slowed dramatically. The current number of U.S. households is about 4.9 million below what the trend prior to the recession would have predicted. “Until the labor market shows sustained strength, the pace of household formation is likely to languish around current levels,” say Barclays analysts in their latest outlook for 2012 home prices.

In the second quarter, less than 66 percent of households owned their homes, the lowest rate of home ownership since 1998. Renting is the fast-growing trend, especially among the financially strapped, those facing foreclosure, and young people, according to the latest outlook from Freddie Mac. In the year through the second quarter, the Census Bureau says 800,000 new households were formed, but that reflects a mix of 600,000 fewer homeowners and 1.4 million new renters. The drop in homeownership has been the steepest for heads of households under 30 years old.

The Barclays outlook expects prices to end 2011 close to 2 percent below a year ago and then increase modestly by about 1.5 percent in 2012. Those projections are similar to most, but with one key assumption: The U.S. doesn’t relapse into a recession, caused by the failure of policymakers in Europe to prevent a full-blown financial crisis or by actions of U.S. policymakers that would impose excessive budget tightening next year. In a recession scenario, the analysts project an additional 7 percent drop in house prices, accompanied by a 12 percent jobless rate.

Barring that, 2012 is set to be the first year of the housing recovery, but it may not feel like one until mortgage restrictions ease and the labor markets are strong enough to offer more support.