|

The Great Recession drove state budgets into a long dark tunnel. Now, after four years of painful measures to close some $500 billion in budget shortfalls, state legislatures are starting to see a glimmer of light. Revenues are picking up smartly and broadly, while the biggest and most painful spending cuts are already on the books. Many states remain far from a full recovery, but unless the U.S. economy slides back into recession, state finances finally appear to be headed in the right direction.

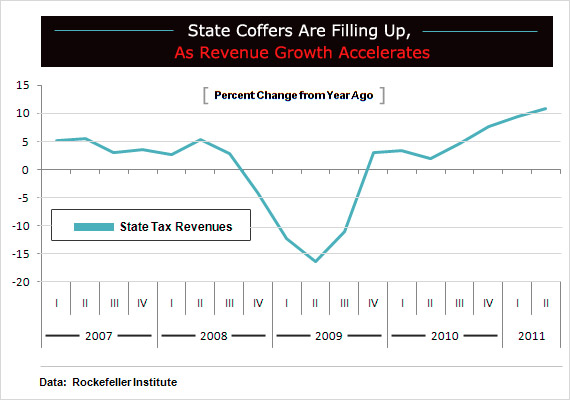

Stronger revenues are driving the turnaround. Receipts in nearly all states are now either stabilizing or improving. Tax revenues in the second quarter rose by a strong 10.8 percent from a year ago, and receipts have nearly returned to the peak level reached four years ago, according to data from the Rockefeller Institute and the Census Bureau. Rockefeller analysts say every state but New Hampshire reported revenue increases for the quarter, and preliminary data for the third quarter show continued gains. The figures reflect tax receipts in the final quarter of fiscal year 2011, which ended on June 30 for 46 states, and the rise in revenues during the entire fiscal year was the strongest since 2005.

The economy might even provide a bit more help in FY 2012, which began on July 1, than it did in FY 2011. Economic growth in the third quarter picked up to a 2.5 percent annual rate after averaging only 0.9 percent in the first half, and economists have raised their fourth-quarter forecasts. Job growth in recent months also looks firmer than it did in the spring.

Recent revenue gains are impressive, given that

for the first time in 10 years states overall enacted

more tax cuts than tax hikes.

October payrolls grew by a tepid 80,000 and the jobless rate dipped to 9 percent from 9.1 percent in September. However, upward revisions to August and September payrolls mean that private-sector job gains have picked up notably. More jobs will boost revenues from income and sales taxes, which account for two-thirds of state receipts.

Recent revenue gains are impressive, given that for the first time in 10 years states overall enacted more tax cuts than tax hikes, by a net $2.5 billion, according to the National Conference of State Legislatures. That balance mainly reflected the expiration of temporary tax hikes in several states. The NCSL also noted that yea-end balances, or rainy-day reserves, which the NCSL says is a key measure of state fiscal health, are edging higher into the 5-to-6 percent range as a share of overall spending. That’s still below pre-recession levels but above the low point in FY 2009.

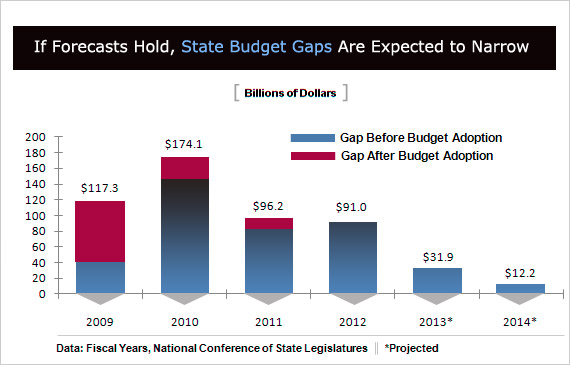

Because 49 states have laws requiring a balanced budget, states are still working through the sharp cutbacks in spending and services that were necessary to close the $91 billion gap between receipts and outlays they faced heading into FY 2012. Despite the pickup in revenues, outlays for mandated programs, especially Medicaid, continue to grow rapidly, even as states are in the middle of steep cuts to education budgets, and future Washington policy remains a big unknown. “States are reporting more optimistic and positive news,” said NCSL executive director William Pound commenting on the NCSL’s State Budget Update, “but they are not out of the woods yet.”

It’s still not known how decisions by the congressional Super Committee in charge of finding $1.2-to-$1.5 trillion in federal budget cuts over the next decade by Nov. 23 will affect state budgets. For now, failure to agree on a plan is set to trigger automatic cuts beginning in October 2012, the start of the federal 2013 fiscal year, unless lawmakers opt for some wiggle room. More immediately, if Congress allows several current stimulus measures including extensions to the payroll tax cut and jobless benefits to expire at the end of this year, economists estimate the loss of those programs would shave some 1.5 percentage points off economic growth in early 2012, a would-be blow to state coffers.

The state portion of Medicaid costs, which is now

more than 20 percent of state budgets, will

increase by 25-33 percent in FY 2012.

States are coping with the loss of federal aid from the 2009 Recovery Act. NCSL fiscal director Arturo Perez says most states have increased their overall revenues in FY 2012 compared with FY 2011, even without Recovery Act funds. Those funds dwindled to only $6 billion in FY 2012, compared with $59 billion in FY 2011, and the act’s extra assistance for Medicaid ended on July 1. The pressure on Medicaid outlays remains intense. The Kaiser Commission on Medicaid and the Uninsured has estimated that the state portion of Medicaid costs, which is now more than 20 percent of state budgets, will increase by 25-33 percent in FY 2012.

Most states have already taken measures to close $91 billion in budget shortfalls they faced heading into FY 2012. New gaps are sure to open up in a few states before the end of FY 2012, but additional measures will most likely be smaller than those required in FY 2011. Although some states are forecasting shortfalls for FY 2013 and FY 2014, the NCSL says fewer states expects gaps and the size of those imbalances are declining, to $31.9 billion and $12.2 billion, respectively.

While state finances are improving, the outlook for local governments is getting worse, partly at the expense of state budget cutting. Cities are getting hit by both cuts in state aid and the lagged effects of falling home prices on property taxes, which before the recession together accounted for about 75 percent of local revenues. The National League of Cities reports that about half of cities have suffered cuts in both direct state aid and state-shared revenues, and the League expects property taxes to decline 3.7 percent this year, with further losses likely in 2012 and 2013.

Ultimately, the fiscal outlook for state and local governments will depend primarily on the health of the private-sector economy. Over the past year, overall real GDP has grown a tepid 1.6 percent, while private-sector GDP, excluding government at all levels, has grown a stronger 2.6 percent, only a shade below the 2.9 percent average annual pace during the three years before the recession. That has a lot to do with why state revenues offer a glimmer of hope, but the pace will have to continue before states can see the full light of day.