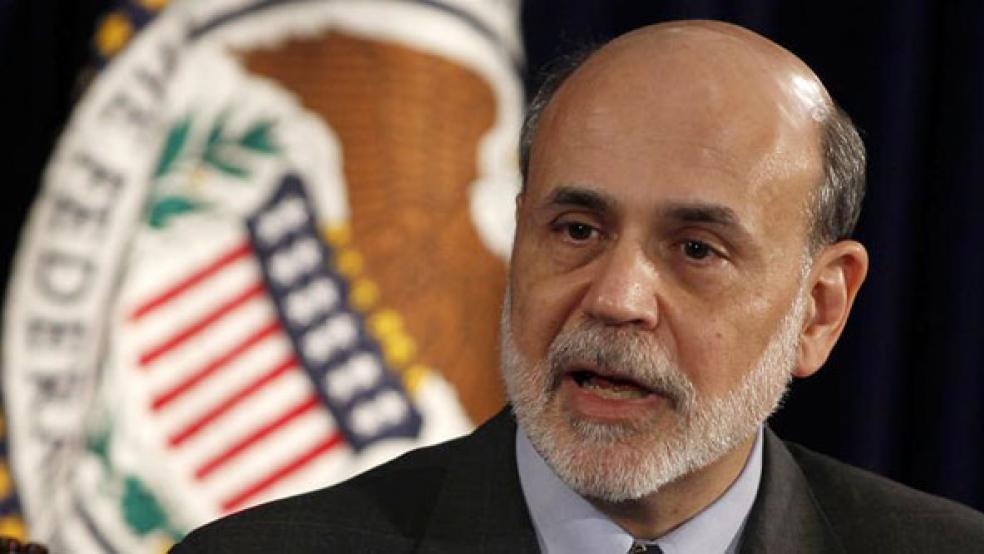

On Tuesday, the Federal Reserve announced that it would continue its policy of exceptionally low interest rates for at least another two years. It believes that this is a policy that will be most conducive to growth. However, some economists are starting to question this policy, viewing it as evidence of “financial repression” that may be hindering growth.

Interest rates have fallen sharply over the last several years. In 2006, the prime rate charged by banks to their best customers was close to 8 percent and the rate on new mortgages was close to 7 percent. The AAA corporate bond rate was close to 6 percent and rates on risk-free Treasury securities were close to 5 percent. Lately, the prime rate has been 3.25 percent, the new mortgage rate has been a bit over 4 percent, the corporate bond rate has been just under 4 percent, and the rate on short-term Treasury securities is barely above zero.

A key reason for low interest rates is that the Fed has reduced the fed funds rate to between zero and 0.25 percent (one quarter of one percent). This is the rate that banks charge each other on overnight loans. Therefore, it is the basic cost of money to banks. In 2006, this rate was close to 5 percent. The Fed effectively controls the fed funds rate by being willing to create as much money as necessary to keep the rate in its target range.

In theory, a low fed funds rate should bring down the entire rate structure until financial markets begin to fear that an increase in the money supply has become inflationary. At that point, long-term interest rates will rise by approximately the expected inflation rate. Thus, if markets expect one percent higher inflation in the future, long-term rates will rise one percent so that lenders get the same real rate.

For this reason, economists view the term structure of interest rates—the ratio of short-term rates to long-term rates—as an accurate measure of expected inflation. This is particularly easy to calculate by looking at the market for Treasury inflation-protected securities (TIPS), which increase the principal on bonds by the consumer price index. Since the principal on regular Treasuries are not protected, comparing rates between the two classes of securities tells us exactly how much inflation markets expect at any moment in time.

Despite a sharp increase in the money supply, inflationary expectations have fallen, yet business investment and home buying have not picked up.

According to the Federal Reserve Bank of Cleveland, the TIPS market shows that inflationary expectations continue to be very low and falling. Financial markets are expecting just over one percent inflation for the next several years and less than 2 percent over the next 30 years.

In theory, low interest rates should stimulate growth because businesses will borrow to invest in new plant and equipment, and both businesses and consumers will refinance loans to free up cash flow and increase disposable income. And insofar as low interest rates reflect an easy money policy, they should raise inflationary expectations. If businesses know that they will be able to charge higher prices in the future, the prospect of increased profits should also stimulate investment. Families expecting higher home prices in the future should want to buy now and so on.

None of these things are happening. Despite a low fed funds rate and a sharp increase in the money supply, inflationary expectations have fallen. Consequently, business investment and home buying have not picked up. Economists are puzzled as to why this is the case.

Conservative economists often assert that increased government regulation, especially in the area of health care resulting from passage of the Affordable Care Act, is the key factor holding back growth. Empirical analysis, however, does not support this conclusion.

Liberal economists believe that the principal factor holding back growth is a lack of aggregate demand due to cutbacks in consumption by households, investment by businesses, and spending by state and local governments.

The falloff in consumer spending has been the largest contributor to slow economic growth because it represents two-thirds of the gross domestic product. Generally speaking, personal consumption is a function of personal income—if people have more income, they will spend almost all of it.

Over the last several years, the Fed’s low interest rate policy has sharply reduced personal income. In 2008, people earned $1.4 trillion in interest income, 11.1 percent of total personal income. In 2011, interest income fell to $1 trillion and represented just 7.7 percent of personal income. If people were still receiving as much interest income in relative terms as they were in 2008, total personal income would be $450 billion higher. More than likely, personal consumption and GDP would be higher by about the same amount. That would have given the economy a robust rate of growth, rather than a barely adequate one.

Quite simply, there are two sides to the low interest rate coin. While it lowers the cost of borrowing, it also lowers interest income. And while the debt service ratio for households has fallen, so has the growth of debt. In the early 2000s, household debt grew at double-digit rates; over the last four years, it has grown at a negative rate, as people pay down or discharge more debt than they acquire. While debt may have grown too much in the past, it may be growing too slowly now.

Some economists, such as Robert Higgs, are starting to focus on the low level of interest income as a key factor in slow economic growth. They note that those individuals most likely to depend on interest income, such as the elderly, have been forced to cut back sharply on their spending.

Alternatively, savers must seek out riskier investments than they would prefer in order to get a decent rate of return. This may create a financial bubble of the sort that created the current economic mess.

Other economists, such as Carmen Reinhart, believe we may be seeing the beginning of what she calls “financial repression”—a deliberate government policy of holding down interest rates in order to make the federal debt more bearable. While this may help the federal government, it comes at the expense of consumers and perhaps economic growth as well.