They say there is a silver lining in everything. In this case, even stock market scares.

The selling pressure that reached a crescendo last week has set the stage for an economic surge heading into the holiday shopping season and early 2015. While the Dow Jones Industrial Average's flirting with the 16,000 level rattled a lot of investors, it contributed side benefits that are poised to bolster retail spending, the housing market, and job growth in the months to come.

Related: The Bull Market Isn’t Dead Yet

To understand this, you need to understand that the selloff didn't originate in stocks but in currencies, commodities, and bonds. A combination of factors had lifted the U.S. dollar nearly 8 percent against a basket of other currencies, to levels not seen since 2010. That crushed the commodities complex, especially crude oil, as West Texas Intermediate futures have dropped from a high of $107.68 a barrel in July to a low of $79.78 last week in the midst of the stock market scare. The energy price pullback has been the most severe since the financial panic in 2008.

As a result, wholesale gasoline futures have dropped by a third from their summertime highs, to $2.13 a gallon last week for the first time in four years.

Paul Ashworth at Capital Economics believes this drop in at-the-pump prices, as it plays out, will reduce forced spending on gasoline by roughly $30 billion annualized. That should be enough to lift household spending on other goods and services by approximately 0.4 percent in the fourth quarter, raising the fortunes of retailers during the critical holiday shopping season.

Related: Falling Gas Prices Could Provide $40 Billion Boost to Economy

This could provide a much-needed impetus to retail stocks, which have been in a holding pattern since last November. A break above the September highs would end the nearly yearlong consolidation range and set the stage for a powerful move higher.

After currencies and commodities, bonds were the next market to fall. High-yield corporate bonds were sold hard as traders piled into Treasury bonds for safety. On October 15, the day of maximum fear, the 10-year Treasury yield tested below the 2 percent level for the first time since early 2013. That's a big change from the high of 3.04 percent hit last December — representing a drop of about one-third (which is also the magnitude of the drop in wholesale gasoline futures).

What makes this drop in borrowing costs so powerful is that it has come at a time of accelerating U.S. economic performance, with the unemployment rate falling to 5.9 percent in the midst of the strongest run of job creation since the dotcom bubble. This has confounded officials at the Federal Reserve, who have seen the market's expectations for rising interest rates lag behind their own.

Related: Why Stocks Suddenly Look as Good as They Have in Years

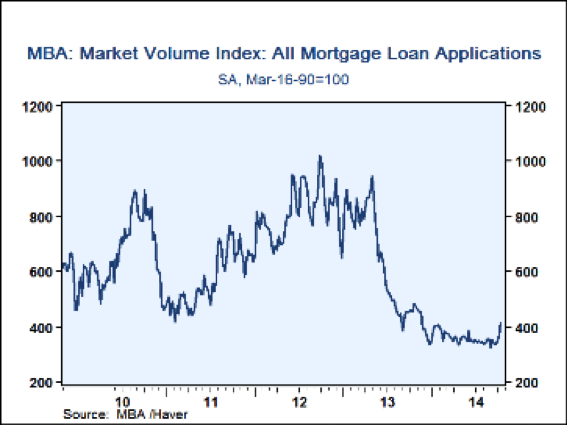

The good news is that all of this is a boon to consumers as well as the housing market, which had stalled a little in recent months. The 30-year mortgage rate has fallen from a high of 4.6 percent late last year to 4.0 percent last week. That's encouraged a turnaround in both mortgage refinancing (unlocking consumer purchasing power by lowering interest payments) and home sales.

The Mortgage Bankers Association reported on Wednesday that applications for fixed-rate mortgages increased to the highest level since January as consumers finally start moving to lock in lower borrowing costs. There was also a surge in loan sizes, suggesting that the refi benefit is trickling up the socio-economic ladder where it will have a larger impact on the volume of retail spending.

Separately, existing home sales returned to levels seen last September as a drop in mortgage rates, and a cooling of the pace of home price gains, has brought buyers back. According to the Federal Housing Finance Agency Home Price Index, home price gains are stabilizing as a result. The year-over-year change increased to 4.8 percent in August from 4.6 percent in July — the first increase in the annual rate of change since late last year. While the pace of home price gains is down markedly from a high of nearly nine percent during the summer of 2013, it's a clear improvement.

Investors are responding to this dynamic as well, pushing up the iShares Dow Jones U.S. Home Construction ETF (ITB) nearly 14 percent from its lows last week. The ETF now looks ready to move out of a long sideways consolidation range going back to early 2013.

Going forward, I'll be watching lumber futures for an upside breakout confirming the improvement in housing. Lumber prices have been mired in a two-year-old sideways amble and tend to act as a leading indicator for both housing stocks and the housing market overall.

Long story short, blessings often come disguised. In this case, consumers and the broad economy are set to benefit from the worst stock market selloff in two years — a selloff that's been quickly recovered in a surge of new buying. Sounds like a win-win to me.

Top Reads from The Fiscal Times: