Stocks pushed to new record highs on Friday in response to a short-term agreement on the Greek bailout between Athens, the Eurozone, the European Central Bank and the International Monetary Fund.

It's not a done deal yet. Greece will need to draft a list of proposed economic reforms by Monday. And the extension just pushes back the deadline on some tough issues to April.

Related: A Greek Bailout Extension? Now Comes the Hard Part

If the European establishment and the International Monetary Fund don't approve of the reform proposals Greece submits on Monday, officials have told the Financial Times that another full meeting of Eurozone finance ministers will happen on Tuesday. So the risk that the deal will collapse is still very real.

As far as winners and losers, Athens seems to have gained some flexibility on the size of the budget surplus it will be required to run this year, and it could potentially win debt relief in any new agreement that is negotiated over the next four months. The European establishment gained a recommitment to the existing bailout program from Greece's new government and a pledge to stop unilateral, anti-austerity actions.

Still, a wide gap remains on some very contentious issues.

Greek Finance Minister Yanis Varoufakis said on Friday that public pensions would not be cut and taxes would not be raised. European officials, by setting the deadline for a new deal in April, have backed Athens against the wall of large debt maturities coming in May and June, raising the stakes of any failure by increasing the risk Greece would have to default on its obligations.

There is also the question of whether or not the Greek people will support this agreement. By taking a hardline stance, the Syriza party enjoyed an approval rating of 80 percent heading into this meeting. The wheelchair-bound German Finance Minister, Wolfgang Schaeuble, warned that the "Greeks certainly will have a difficult time to explain the deal to their voters."

Related: The World’s Top ‘Financial Firefighter’ on How to Douse the Greek Debt Crisis

The first hurdle is Monday. Varoufakis himself warned that if the Eurozone doesn't accept Athens' reform proposal, Friday's deal is "dead and buried."

After that, a new agreement will need to be hammered out by April that recognizes that Greece is in a debt-deflation trap with a fragile banking system, is suffering from a 26 percent unemployment rate and a youth unemployment rate of more than 50 percent and is in real need of debt relief.

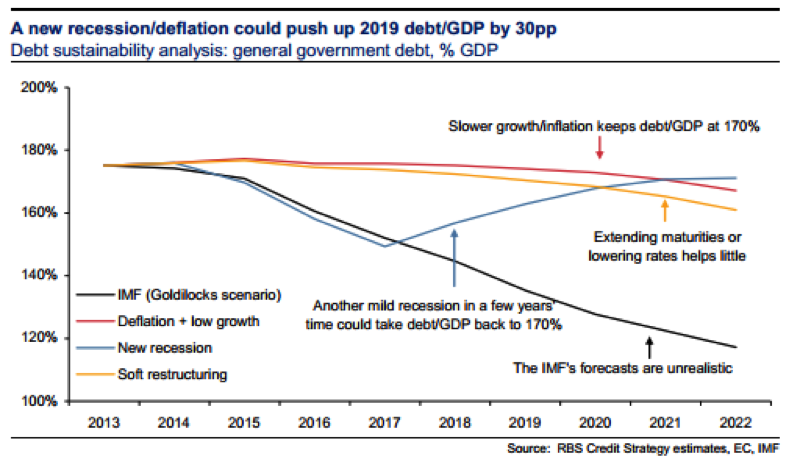

Alberto Gallo at the Royal Bank of Scotland, who has been closely following the machinations between Greece and Europe, is a fan of Athens' preference of replacing some of its debt load with GDP-linked bonds in which interest payments are dependent on economic performance. The goal is to hit the IMF's target of pushing the Greek debt-to-GDP ratio back down to 120 percent vs. the 170 percent Gallo believes Greece will hit within the next seven years as its economy stalls.

To rectify the situation, Gallo estimates that the European establishment needs to reduce its debt holdings against Greece by a third. The recalcitrance of Germany means this isn't realistic. Growth-linked bonds could be a compromise solution.

Of course, even assuming Greece and Europe come to an agreement that lessens the debt burden and eases the terms of its bailout arrangement, there is a risk that the rise of anti-austerity political parties in places like Spain will open Pandora's Box and result in other countries seeking similar budgetary relief. If Greece gets a break, why can't we?

In other words, Europe is far from fixed. The crisis, which started in 2010, is just entering yet another chapter.

Top Reads from The Fiscal Times:

- U.S. Marines on the Ground in Iraq as ISIS Burns 45 Alive

- West Coast Port Dispute Shows Just How Fragile the U.S. Economy Has Become

- Why Some Americans Will Never Give Up Their Guns