Suddenly, Wall Street’s new narrative is breaking down.

For months, the Street tried to convince itself that an interest rate hike from the Federal Reserve, which hasn't happened since 2006, would be a good thing. It would be a sign of economic strength. It would forestall concerns of nasty asset price bubbles. And it would signify the economic recovery was maturing nicely.

But now, fears both old and new are appearing. And as a result, markets are looking vulnerable again to the volatility and weakness of August and September.

Related: Global Trade Is Falling to Recession Levels

As the Dow is pushed away once more from the 18,000 level, commodities, high-yield bonds and small-cap stocks are all warning recent enthusiasms were misplaced. All of this comes in the wake of Friday's much stronger-than-expected October payroll report, which has pushed up the futures market odds of a December rate hike by the Fed to 74 percent.

Attention is focusing on two pillars of stock market bullishness: corporate earnings and the pace of debt-funded corporate stock buybacks, dividends and M&A transactions.

A strong U.S. dollar and weak commodity prices — especially energy — have weighed on earnings growth directly via low crude and metals prices as well as indirectly by reducing the value of repatriated foreign earnings.

As a result, according to FactSet data, the third quarter earnings season is set to feature a 2.2 percent decline in S&P 500 profits — the first back-to-back quarterly decline since 2009. It's also on track to be the third consecutive quarter of revenue declines. These concerns are directly addressed in post-earnings comments during the Q3 reporting season:

"Foreign exchange was a $1.2 billion drag on Industrial segment revenue and $165 million impact on Industrial segment op profit." –General Electric (Oct. 16)

"I do want to point out foreign currency translation remains a strong headwind as we continue to expect this to impact full year EPS by about 5 percentage points." –YUM! Brands (Oct. 6)

"NIKE, Inc. revenues grew 5 percent to $8.4 billion despite significant FX headwinds." –Nike (Sep. 24)

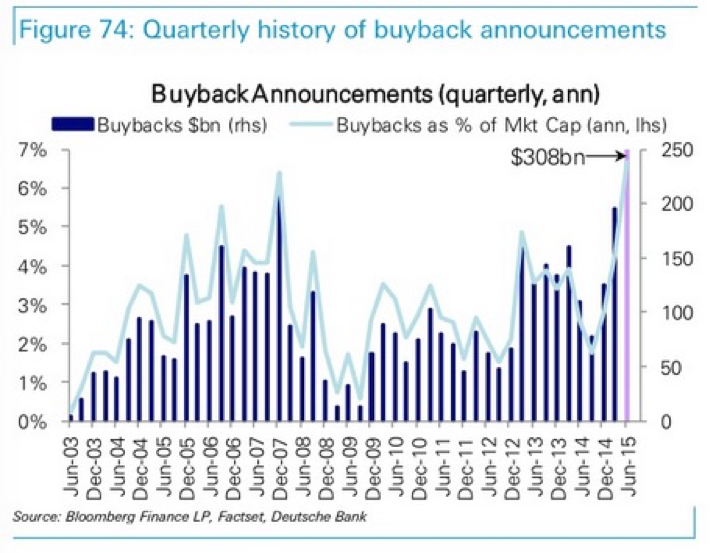

This dynamic is set to accelerate as the Fed's rate hike approaches. The U.S. dollar has surged to highs last seen in April and is approaching levels not seen since 2003. The combination of ultra-low credit and a low-growth recovery has encouraged CEOs to plow free cash and the proceeds of new debt issuance into buybacks, which are at record highs, according to Deutsche Bank. No surprise then that actual investment in machinery, people and factories has been among the weakest in a post-war recovery, according to Bank of America Merrill Lynch.

This has artificially juiced stocks, despite top-line sales pressure, by improving earnings per share comparisons. It has also laid the foundations of future problems by withholding capital expenditures needed in the real economy to keep labor productivity rising and increase overall standards of living.

Related: How Rising Rents Are About to Crush American Spending Power

We will reap that harvest in due time, likely in the form of a big, unexpected increase in wage inflation as companies scramble for human capital. We are already hearing anecdotal evidence of this:

"Expenses related to the pay increases that go into effect on December 1 are creating about a point of pressure...." –Delta Air Lines (Oct. 13)

"Wage pressure continues to be a problem. We'll continue to monitor it as we monitor the different states and the different cities and what they're doing with minimum wage." –Darden Restaurants (Sep. 22)

"Yeah, we don't have any plans right now for any kind of a national price increase to deal with wage pressure..." –Chipotle Mexican Grill (Oct. 20)

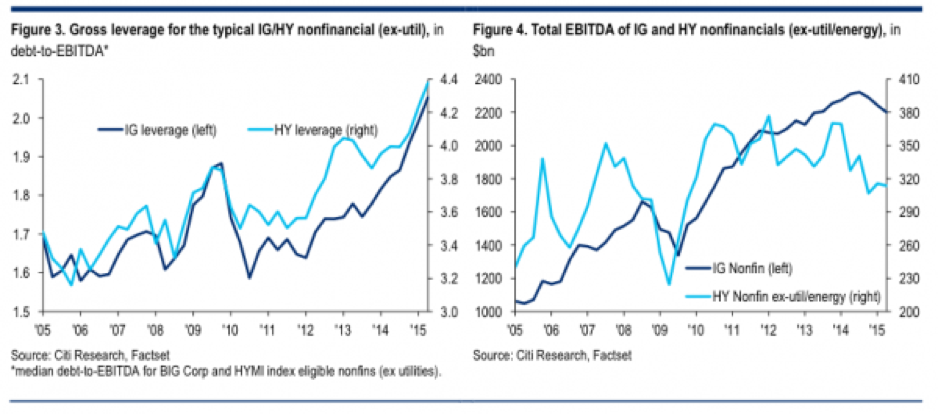

But the more immediate problem is that the pressure on earnings is coming at a time when corporate balance sheets are already overleveraged, as shown by the charts above from Citigroup. Higher long-term interest rates resulting from a likely December Fed hike will only make this worse, increasing the cost to roll over expiring debt and making the issuance of new bonds — especially if used to repurchase stock — less accretive to earnings. All while additional top-line pressure comes from the strong dollar and weak commodity prices.

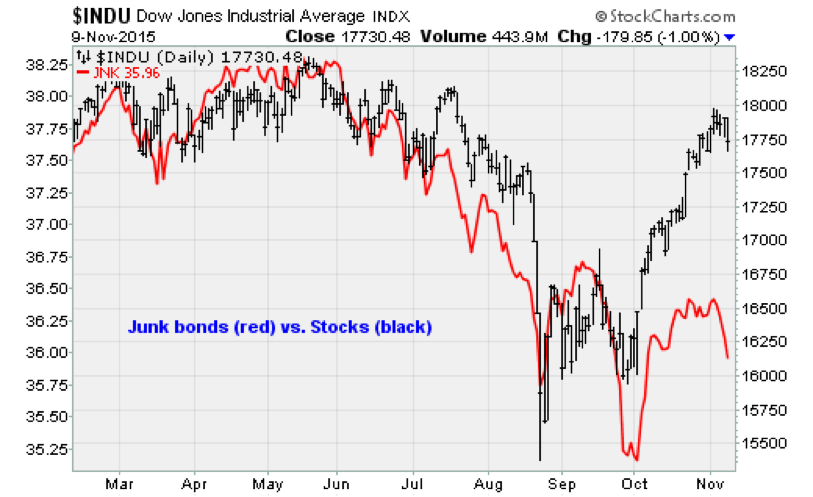

As you can see in the charts above, high-yield corporate bonds are already warning of trouble. Stocks won't be able to ignore the problems much longer, meaning a Fed rate hike is unlikely to be as benign as the optimists are hoping.