Sometimes, random events suggest a larger force is in control.

Like when the S&P 500 bottomed at 666 on March 6, 2009 (03/06/09) during the last bear market. That was just a little too perfect, pointing to a devilish influence behind the whirlwind of fear, greed, speculation and cheap credit that created and then crashed the housing bubble.

Now, noted bear Albert Edwards at Societe Generale warns: Stocks are headed even lower, revisiting 666 on the way to the hellish price destruction that lies below.

Related: Is China or the Middle East a Bigger Threat to Stocks?

Just look at what happened on Wednesday. The selling was persistent, unyielding and powerful as U.S. equities melted lower. There was no specific catalyst for the decline, only a growing sense of fear that policymakers both here and overseas have lost control of the situation: Energy prices keep weakening, currency volatility increases and the economic data continues to soften.

Much of the fear stems from concern that the Federal Reserve made a policy mistake when it raised interest rates by 0.25 percent in December, the first hike since 2006. Either they waited too long. Or they didn't wait long enough. It's not clear which just yet.

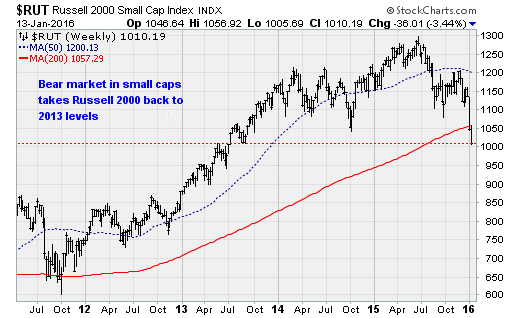

But the result is clear: Small-cap stocks are now down 22 percent from their June high, officially entering a bear market. Large-caps aren't far behind: The NYSE Composite is down 16.7 percent from its May 2015 high.

Edwards lays the blame squarely on the Fed and other major central banks. Their "pursuit of negligently loose monetary policies since 2009 is a misguided attempt to boost economic growth via asset price inflation and we will now reap the whirlwind," he wrote.

Related: China’s Rosy Trade Numbers May Reflect a Darker Trend

The crux of the problem is what's happening in China, which is being forced to devalue its currency and, in the process, set off a global deflationary impulse that will hit U.S. manufacturing right in the face and worsen the commodity price decline slamming shale oil and materials producers. Poor energy and material earnings are driving expectations of another quarterly earnings decline for the S&P 500, which would mark the first three-quarter streak of falling profits since the financial crisis.

I’ll spare you by not delving into details like the impact on dollar-denominated Chinese corporate debt and the relationship between the on-shore yuan and off-shore yuan valuation rate, but Edwards believes we're headed for a valuation bear market "that did not fully play itself out in March 2009" and has historically taken four to six recessions to fully manifest.

This relationship is shown in the chart above; which Edwards admits is a little dated but illustrates his point. In March 2009 the Shiller 10-year Price-to-earnings measure of stock market valuation bottomed at 13.3x, way above the typical sub-7x nadir of valuation lows. Currently, that Shiller P/E is back above 26x.

Related: Misreading China Leads to Another Foolish Market Rout

Edwards delivers this chilling takeaway:

"If I am right and we have just seen a cyclical bull market within a secular bear market, then the next recession will spell real trouble for investors ill-prepared for equity valuations to fall to new lows. To bottom on a Shiller PE of 7x would see the S&P falling to around 550. I will repeat that: If I am right, the S&P would fall to 550, a 75 percent decline from the recent 2100 peak."

Obviously, the Fed would aggressively fight this collapse in wealth with a likely decline in interest rates to -5 percent, accompanied by fresh rounds of quantitative easing.

Could this dark scenario get any darker?

The outbreak of an outright currency and trade war would do the trick. Already, according to the monthly World Trade Monitor, global trade declined for most of last year, the weakest performance since 2009. The U.S. just imposed punitive sanctions on Chinese steel imports of 256 percent. And leading GOP presidential contender Donald Trump has outlined an aggressive position on challenging China on trade.

Even without those developments, though, investors may have a devil of a time ahead.