The stock market's obsession with monetary morphine has fueled a new high. The Dow Jones Industrial Average is up for 14 of the last 16 sessions, including nine sessions in a row and seven straight record closes. The cumulative result has been an epic 9 percent surge off of the late June "Brexit" low — all merely on the hopes and nonspecific hints of more central bank stimulus.

But, in an example of reflexivity, the aggressive confidence seen over the last few weeks diminishes the need for said stimulus. The Bank of England, at the epicenter of the Brexit fallout, held off on any new action and has found that the vote to leave the European Union hasn't hurt the economy. And the odds of a Federal Reserve interest rate hike in July or September have started rising again.

Investors, apparently, haven't thought through the logic of all this, as stocks continue to push to new highs. This begs the question: Is this a dumb money rally? If so, what could end it?

Related: Throwing Shade on the Dow's New Record High

The chart below speaks volumes about the narrow, no-volume reversal. As the market's climbed to new records, it's been doing it on the back of fewer and fewer stocks. In fact, there were more stocks rising when stocks were topping back in April than there are now. Very odd.

There's more. Wall Street pros are nervous, valuations are high, fund managers are holding large cash reserves, the corporate earnings recession continues and U.S. economic data suggest inflation is coming back to life (which will make withholding Fed rate hikes increasingly difficult).

The latest Bank of America Merrill Lynch Fund Managers' Survey finds that July cash levels are at 5.8 percent, up from 5.7 percent in June and the highest level since November 2001. Many survey respondents are also taking out protection against a sharp decline in stocks, with more worries about a downside surprise than in the midst of the financial crisis in late 2008.

The result of all this is the first industry equity underweight positioning in four years, as shown in the chart above.

Related: Why Clinton or Trump Could Face a Stock Market Nightmare

Jason Goepfert at SentimenTrader notes that his own measure of "Dumb Money" vs. "Smart Money" sentiment — a measure of how the big boys are feeling compared to the small fish — shows that, through Tuesday, the dumb money was 76 percent confident in the rally while the smart money confidence level was at 18 percent.

Historically, gaps this large have been a bad sign for stocks going forward: Every time it’s happened in the last 20 years, any further short-term stock market gains were erased during the subsequent pullback.

What could be the catalyst for the eventual reversal? Renewed weakness in crude oil.

Related: The US Now Has More Oil Reserves Than Saudi Arabia or Russia

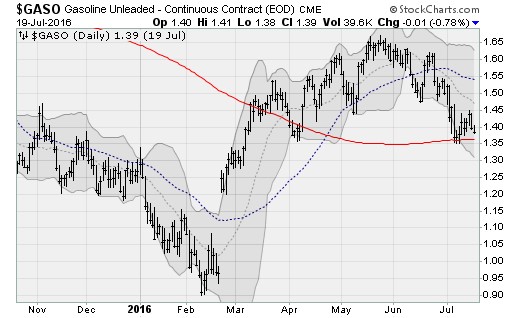

Energy prices look vulnerable to a breakdown here as U.S. production ramps up and overseas supply disruptions fade while inventories remain bloated. These recent trends have led to a turn higher in the backlog of refined gasoline, which started the summer driving season well above levels seen since 2012.

A dramatic comedown in energy prices would rattle oil and gas stocks — the catalysts for the rally out the February low — and make investors worry about the return of a negative factor they've not dealt with for months.

On a technical basis, keep an eye on wholesale gasoline, which is testing support at its 200-day moving average as shown above. A breakdown here would violate the early April lows and set up a possible move back to the late February price level near $1.10. That would represent a 20 percent decline from here and would be just the thing to shock the stock market out of its fever dream.