The Dow Jones Industrial Average has gained in all but three trading sessions since the June 27 Brexit low. The uptrend seems unstoppable. News of a shooting attack in Munich were ignored. Disappointing "no change" decisions by the European Central Bank and the Bank of England have been shrugged off.

Behind the façade of strength, though, vulnerabilities are appearing. Crude oil has dropped nearly 15 percent from its early June high to return to levels not seen since May. With major oil companies set to report earnings results this week, late buyers are at risk.

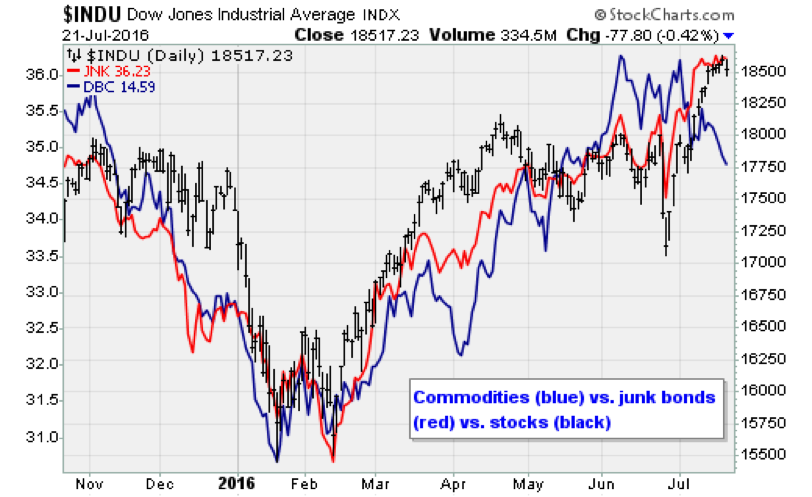

The fresh weakness in oil is the most significant threat to the current run that has capped a near-20 percent gain out of the February low. It undermines the "all hands on deck" uptrend the bulls have enjoyed since February and has accelerated since the Brexit vote in late June. Pretty much every asset class from stocks to risky bonds to gold has been flying higher.

Related: Throwing Shade on the Dow's Record High

Investors will be hard pressed to ignore the still-serious headwinds facing energy prices and still-cratering energy sector profits. An old concern is about to make an unwelcome return: Oil price deflation.

Deteriorating supply-demand dynamics (especially in refined products like gasoline) hit crude oil hard last week, and thus by extension, jeopardize energy stocks. The U.S. Oil Fund (USO) is down to levels not seen since April and is threatening a breakdown out of a two-month downtrend channel as shown above.

Related: The US Now Has More Oil Reserves Than Saudi Arabia or Russia

I covered the supply-and-demand situation for crude oil in my last column; now, I want to focus on what's happening to energy stocks.

Just look at ExxonMobil (XOM), which has been in an inexorable uptrend since January as crude oil lifted off its low. In the process, the bulls got a little overzealous, as shown above, resulting in a massive separation of XOM's share price from the rise in energy prices on a relative basis.

Related: Oil Dives on US Rigs Rise, Glut Threat

The company will report results on Friday before the bell. Analysts are looking for earnings of 64 cents per share on revenues of $64 billion. That’s a 70 percent decline in profits compared to the earnings-per-share peak in 1Q14 of $2.10, yet the share price has nearly returned to its 2014 high.

Like XOM, Chevron (CVX) shares have surged higher since bottoming back in January on hopes the worst for crude oil has past. With gasoline inventories bloated, short-term oil supply disruptions fading and U.S. production increasing again, a breakdown in energy prices — and thus energy earnings — looks likely in the second half of the year.

We'll know more when CVX also reports on Friday before the bell. Analysts are looking for earnings of 34 cents per share (vs. 30 cents a year ago) on revenues of $29.6 billion.

The problem, at the industry level, is that positive catalysts such as a potential reduction of supply out of OPEC and Russia combined with industry cost-cutting and capital-expenditure reductions are fading. A new problem — oversupply of gasoline — once again threatens profit margins.

Related: How to See Through Corporate Earnings Smoke and Mirrors

RBC Capital Markets analysts note that gasoline inventories are already 15 percent above their five-year average despite healthy demand and vehicle miles traveled this summer. As a result, gasoline "crack" spreads — or the profit margins for refiners — are well below their five-year range for the U.S. Gulf Coast. Current refining margins are around $10 per barrel; compare that to a five-year high of around $50. RBC expects the weakness to continue through the middle of 2017, weighing on industry earnings.

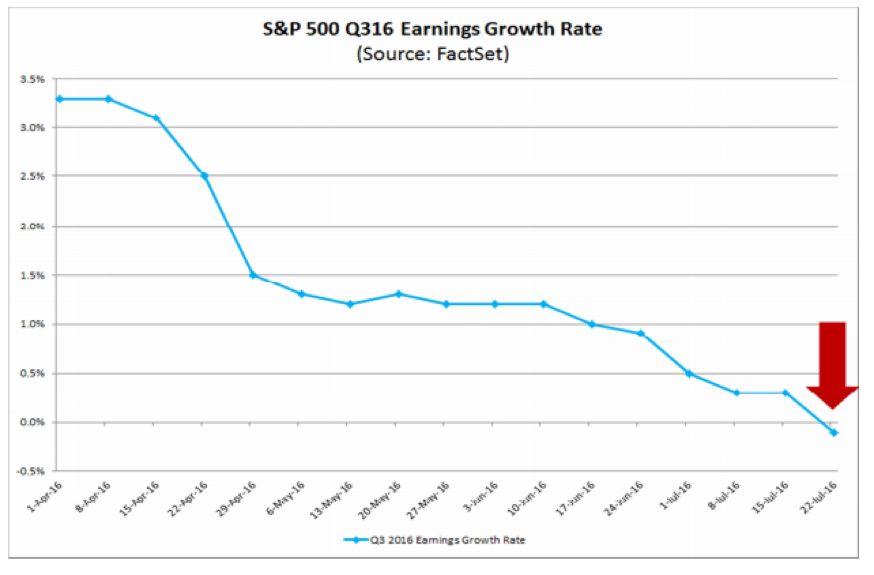

The downturn in energy earnings is once again dragging down overall corporate earnings growth. According to FactSet, the S&P 500 is now expected to post a decline in profitability for the third quarter, which would be the sixth consecutive quarter of negative earnings growth.

For investors who still care about fundamentals like profits and revenues, this makes the stock market's meltup to new highs increasingly hard to justify.