Faith in macroeconomic models plummeted after the Great Recession, and for good reason. The models failed to foresee the economic problems that were coming, the severity of the recession was misjudged, and the models provided little guidance on how policymakers should respond to the economic crisis.

Macroeconomists have since overcome many of these problems. For example, the failure to integrate a meaningful financial sector into the models and working out how monetary and fiscal policy impact the economy when it is stuck at the zero bound. But even today, as Berkeley economist Brad DeLong points out (and as I pointed out long ago), macroeconomists cannot even agree on the importance of various explanations about the primary cause(s) of the recession.

Related: Trumponomics Would Blow a Huge Hole in the Federal Budget

Does that mean economics has little to offer when it comes to evaluating policy proposals from the Trump administration? Have macroeconomic models been tarnished to the point where the Trump administration can disregard economic analyses unfavorable to their proposals because the experts don’t know what they are talking about?

I believe that macroeconomic models and the forecasts they generate have more value than they are given credit for, especially now that the shortcomings in the models are being rectified. But even if we set aside macroeconomic models, basic economics – the concepts that are emphasized in principles of economics courses – still have considerable value in guiding how to think about whether a particular proposal ought to be enacted.

One of the things we tell students who are just beginning to learn about economics is that it will teach them a way of thinking that applies very generally, a way of thinking that will be valuable in almost all areas of life, including making business decisions, evaluating government policy, and making choices in one’s personal life.

The first important principle is how to properly measure economic costs, what economists call “opportunity costs.” The true cost of an economic choice such as deciding to go to college is not measured by the cost of room, board, etc. Suppose, for example, that a year of a public college education costs $20,000. The cost measured in this way does not necessarily reflect the true cost of pursuing an academic degree. Instead, the true cost is the highest valued alternative that could be pursued.

Related: Here’s the Problem With Trump’s Plan to Bring Offshore Cash Back to the US

If, for example, the person could have worked in a family business and made $85,000 per year, that is the cost—what is given up – by choosing to get a year of education (and many people, say an athlete with a huge pro contract, will decide the cost of another year of college is too high even if tuition, books, room and board, etc. are largely covered by a scholarship). In this example, the education costs $85,000, not $20,000, and if the benefit of a year’s worth of education is perceived to be less than that, education will take a back seat.

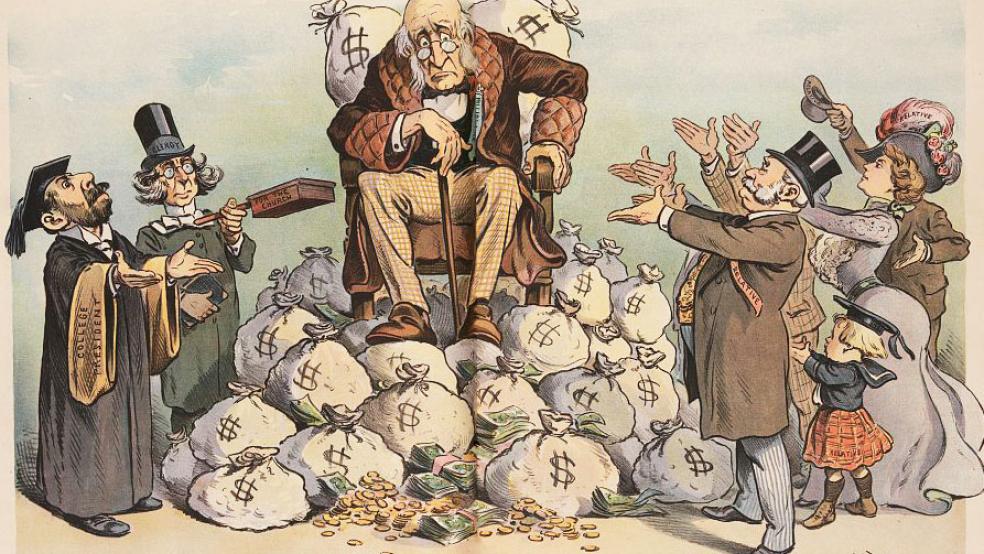

Thus when Trump proposes tax cuts for the rich or any other policy, the true cost is not measured by the dollar value of the tax savings for the rich, but rather what society has to give up to enact the tax cuts. What is the highest valued alternative way the revenues lost from the tax cuts could have been used? Will government programs will be sacrificed to pay for the tax cuts, and if so, as seems likely, how much value does society place on the social programs that are cut from the budget?

This brings us to the second important principle in the economic way of thinking, learning to think “on the margin.” In trying to decide whether, for example, to hire one more unit of labor, the choice can be made by comparing the costs and benefits of having one more worker on the payroll (i.e. “marginal” costs and benefits of one more unit of labor). If the benefit of hiring one more person, the extra output the worker can produce in an hour multiplied by what it can be sold for, exceed the costs, the hourly wage (plus benefits) then the worker should be hired (and the firm should continue hiring until the marginal costs and benefits are equal).

Related: Why GOP Leaders Are Balking at Trump’s Call for Punitive Tariffs

So, to evaluate whether a policy such as tax cuts for the wealthy should be enacted we should compare the costs and benefits that arise from this policy. The cost of the tax cuts has already been discussed. It should be measured by the value of what society gives up to support them, and we should also consider the fact that the policy would make the inequality problem worse.

But what about the benefits? Republicans claim that tax cuts for the wealthy will spur economic growth, and that benefit of higher growth will be far larger than the programs that must be sacrificed to pay for the reduction in taxes. But we don’t need fancy theoretical macroeconomic models to evaluate this claim about tax cuts and economic growth, the empirical evidence is quite clear. The idea that tax cuts will spur economic growth finds very little support when tax cuts in the past are evaluated.

When economists object to policies the Trump administration proposes, the objections are likely to be dismissed based upon the claim the macroeconomic models have failed us. But don’t be persuaded by this argument. Macroeconomic models are better than their reputation, particularly now that many of their shortcomings have been addressed. But beyond that, the Trump administration’s policy proposals can be evaluated using tried and true concepts such as opportunity costs and thinking about costs and benefits on the margin.

If the Trump administration’s policy proposals pass these tests, great, let’s enact them. But if the evidence on the costs and benefits is evaluated honestly, I don’t believe that most of the policies that Trump has suggested – infrastructure spending done correctly is perhaps an exception – can be supported.